Can one person show 2 business under 44AD? What if one business profit is below 6% or 8% under 44AD?

In our earlier post we had discussed whether a person can show income under 44AD and 44ADA simultaneously.

Now, in this post we shall discuss whether a person can show two business under 44AD separately and what will happen if one business has profit below 8% and one has profit above the prescribed limit.

Section 44AD as we know is business wise and not person wise wherein it starts with “in the case of an eligible assessee engaged in an eligible business” thus it talks about eligible business of eligible person.

Hence a person can show more than one person under 44AD and each business needs to fulfill the criteria of eligible business to qualify for 44AD.

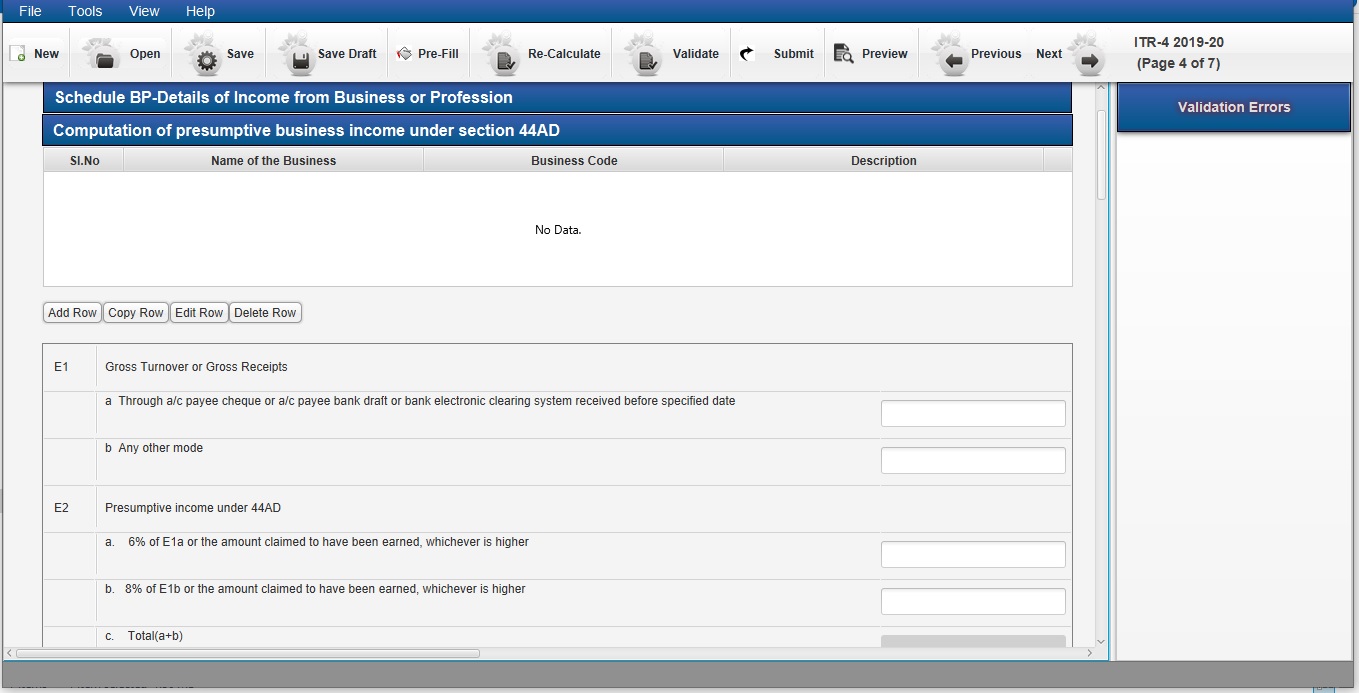

The question here is whether a person can show more than business under 44AD and practically the answer to same would be yes, as per ITR 4 a person can show more than one business under 44AD by choosing more than one business code.

The second question here is can a person show 2 business with one having profit below prescribed limit and one with profit above prescribed limit.

For example: Mr. A is engaged in two business and in both of them he receives payment online but in one his net profit is 5% and in another his net profit comes to 8%.

Now if you look at above image of ITR 4 you will come to know that you have to show gross turnover and total profit under 44AD. Hence in above example even if one business profit is below 6% still you can show it under 44AD as total profit would be above 6% i.e. the prescribed limit.

This again goes on the prove that practically section 44AD has to be seen person wise and not business wise as was discussed in our earlier post.

Thus, although one can show 2 business code and thereby show that he is conducting two business but turnover and profit would go in totallity.