Exception to monetary limit for filing appeal before ITAT, High court and Supreme court

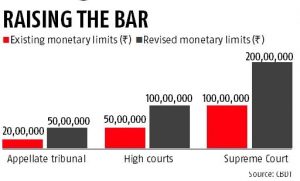

CBDT vide circular 17/2019 had enhanced the monetary limit of tax effect to file departmental appeal before ITAT, High court and Supreme court which has been discussed in this post: Enhanced monetary limit.

The limit was enhanced to reduce to number of pending litigation before the authorities and to concentrate on high demand cases.

However vide notification 23/2019 Dt. 06.09.2019 CBDT has provided certain exceptional cases where the above monetary limit wont apply.

“notwithstanding anything contained in any circular issued U/S 268A specifying monetary limits for filing of departmental appeals before Income Tax Appellate Tribunal (IT AT), High Courts and SLPs/appeals before Supreme Court, appeals may be filed on merits as an exception to said circular, where Board, by way of special order direct filing of appeal on merit in cases involved in organised tax evasion activity.”

One of the example of above exemption is Bogus Long term capital gain/ Short term capital loss in case of penny stocks.

Thus if there are any cases where there is a belief of organised tax evasion, an order shall be passed by CBDT directing that above monetary limits shall not apply to such cases.

If you need assistance you can ask a question to our expert and get the answer within an hour or post a comment about your views on the post and also subscribe to our newsletter for latest weekly updates.