Faceless scrutiny in Income Tax is now a reality. New E-assessment procedure started

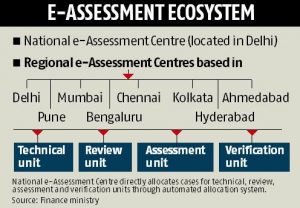

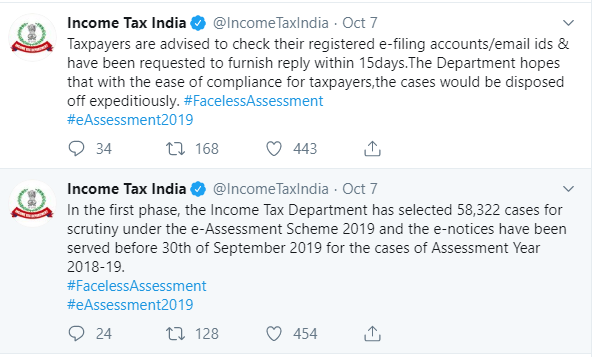

Hon’ble Finance Minister, while presenting the Budget, 2019, made an announcement in her speech that a new scheme of faceless assessment in electronic mode involving no human interface shall be launched during this year in a phased manner. Accordingly, the e-Assessment Scheme, 2019 (S.O. 3264 (E) has been notified on 12.09.2019 in the official gazette. The same has now been initiated to serve notices for assessment with regard to A.Y. 2018-19 and in the first phase 58,322 cases have been selected for e-assessment and they have been served e-notices before 30th September 2019 on their registered e-mail id and on e-filing website. They are also requested to reply to such notices within 15 days so that assessment can be completed quickly and with ease. Same was tweeted by Income Tax department on their official twitter account.

Major changes between previous e-assessment procedure and new faceless scrutiny procedure:

- All communication with the assessee or any other person for the purpose of making assessment under the Scheme, as also internal communication among the functional units, shall be through the NeAC and shall be made exclusively in electronic mode.

- An electronic record under the Scheme shall be authenticated by the originator affixing digital signature. However, an electronic record originated by the assessee or any other person may also be authenticated by affixing electronic signature or any other reliable electronic authentication technique. However earlier also this option was there but no-one really used to authenticate the communication let’s see now with the new faceless scrutiny will this become compulsory or still we would submit it without e-verification.

- As the National e-Assessment Centre doesn’t have any physical address neither assessee nor his authorized representative needs to visit any regional or central office to submit any documents they need to do everything online and if there is any requirement for verbal communication i.e. in case of modification of draft assessment order or where examination or recording statement of assessee is required, then in such same would be done using video conferencing.

You can read the entire procedure of how new E-Assessment scheme would work HERE.

Now let’s have a look at side by side changes evident in notices issued before such E-assessment and after it:

Notes:

- This system of E-assessment would be applicable for Assessment which are now initiated for A.Y. 2018-19.

- According to Income Tax department the notice number issued on each notice needs to be taken as DIN number (Document Identification number) which was required to be generated for each communication issued after 01.10.2019. However this was available before also but now any communication without this would be considered as null and void.

- Now a barcode has also been added to the notice however there is no clarification regarding it’s use.

- Also we need to see how will video-conferencing will be conducted in cases where verbal communication is required as internet connection is not strong in all the areas of India.

If you need assistance you can ask a question to our expert and get the answer within an hour or post a comment about your views on the post and also subscribe to our newsletter for latest weekly updates.