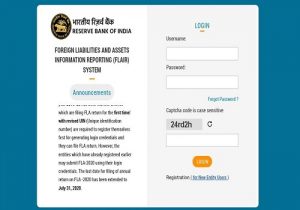

FLA return filing due date extended to 31.07.2020 by RBI

The due date FLA return (i.e. Foreign Liabilities and Asset) which is generally 15th July has been extended to 31st July for this year.

Which companies needs to file FLA?

The annual return on Foreign Liabilities and Assets (FLA) is required to be submitted directly by all the Indian companies which have received FDI (foreign direct investment) and/or made FDI abroad (i.e. overseas investment) in the previous year(s) including the current year i.e. who holds foreign Assets or Liabilities in their Balance Sheets.

If a company did not receive FDI or made overseas investment in any of the previous year(s) including the current year, do we need to submit the FLA Return?

If the Indian company does not have any outstanding investment in respect of inward and outward FDI as on end-March of reporting year, the company need not submit the FLA Return.

If a company has only share application money, then is that company supposed to submit the FLA Return?

If a company has received only share application money and does not have any foreign direct investment or overseas direct investment outstanding as on end-March of the reporting year, then that company is not required to fill up FLA return.

Whether FLA Return is required to be submitted by Registered Partnership Firms (Registered under Partnership Registration Act) or branches or trustees, who have made Overseas Direct Investment or it is mandatory only for Companies (Registered under Companies Act, 1956)?

If the Partnership firms, Branches or Trustees have any outward FDI outstanding as on end-March of the reporting year, then they are required to send a request mail to get a dummy CIN number which will enable them to file the Excel based FLA Return. If any entity has already got the dummy CIN number from the previous survey, they should use the same CIN number in the current survey also.

Is it required to submit Annual Performance Report for ODI, if we have submitted FLA Return?

FLA Return and Annual Performance Report (APR) for ODI are two different returns and monitored by two different departments of RBI. So you are required to submit both the returns if these are applicable for your company.

If non-resident shareholders of a company has transferred their shares to the residents during the reporting period, then whether that company is required to submit the FLA Return?

If all non-resident shareholders of a company has transferred their shares to the residents during the reporting period and the company does not have any outstanding investment in respect of inward and outward FDI as on end-March of reporting year, then the company need not submit the FLA Return.

If company issued the shares to non-resident on Non-Repatriable basis, whether that company is required to submit the FLA Return?

Shares issued by reporting company to non-resident on Non-Repatriable basis should not be considered as foreign investment; therefore, companies which have issued the shares to non-resident only on Non-Repatriable basis, is not required to submit the FLA Return.

To read more about FLA and procedure to file the same CLICK HERE.