Form 26AS i.e. annual information statement will now include monthly GST turnover for the relevant year

With digital India and making all department’s digital it was announced by the government that slowly they will link all government department’s of direct and indirect tax.

As soon as GST was announced, it was a PAN based registration and many people thought that now their Income tax and GST details would be linked.

However till date there was no such direct linking but now CBDT has included month wise GST turnover in 26AS of the tax payer.

Now, if you download Form 26AS for FY 2019-20, which was earlier used just for showing tax paid and refund related details but later it was transformed into Annual Information statement, you can see month wise GST turnover for the relevant year.

With time the details being displayed in Form 26AS is getting increased and it is becoming more and more detailed/ informative.

Also 1-2 years ago Income tax return also included clause for amount of GST turnover and GST number and many people had issue as many a times Income tax return preparer was separate person and GST return was done by a separate person and it was a task to get each month turnover, but now with this it is easy to get GST turnover.

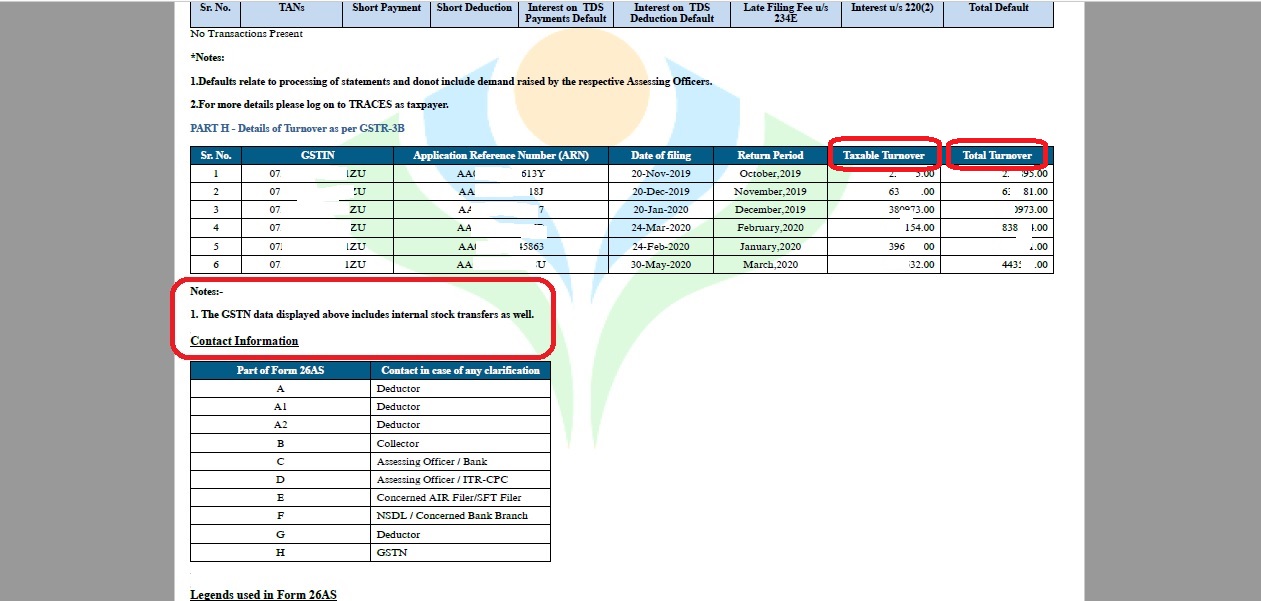

In the above image now you can see that Part H of Form 26AS shall show GST turnover for the GST turnover based on the PAN month wise from the date of registration and if the registration from beginning of year it will show the same for whole year.

The above table will show GST number, month of GST return, ARN number, date of filing, Taxable value and Total value (this will also include zero rate goods and exempt goods and total value).

This will be the data from GSTR 3B. The table also mentions that this will include internal stock transfer as well.

Thus, this will be a useful information to file Income tax return and check turnover mentioned in books with turnover mentioned in GST return but it will surely not always match as GST turnover can also include sale of vehicle, asset etc.