GST website Update: Now file company’s GST return using EVC [Exclusive] and show return frequency on dashboard

GST website has added a few new features on the website for facilitating the taxpayer:

Check last 5 GST returns filed on Dashboard:

Now GST website has made it easy for the taxpayer to check if all the returns are being filed in time and which returns have been filed and one need not go in return dashboard to see each return.

GST website has provided the facility to have a look at same from dashboard itself.

Similarly Dashboard also provides information for changing the option of filing quarterly or monthly return and and one can change the same also from the dashboard itself.

GST Return GSTR-3B and GSTR-1/ IFF for companies can now be filed using EVC: [Exclusive]

Looking at the pandemic although the facility has been brought late but now companies can also file their GST return using EVC which was not possible earlier as they could only file GST return till now by using DSC.

Now, looking at the current pandemic and lockdown as every one cannot visit office for DSC, CBIC has allowed companies to file return using EVC however the same facility will only be available till 31.05.2021.

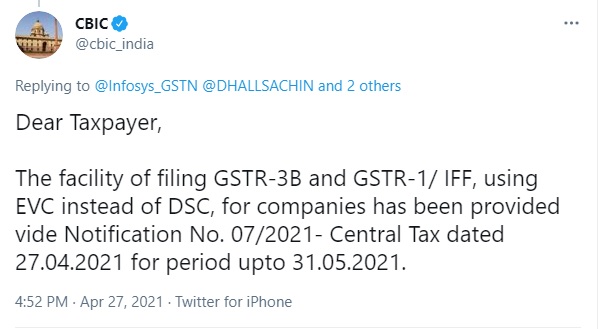

This facility will be made available by Notification 07/2021 Dt. 27.04.2021 as was mentioned by CBIC on twitter.

CBIC in it’s tweet mentioned as below:

“Dear Taxpayer, The facility of filing GSTR-3B and GSTR-1/ IFF, using EVC instead of DSC, for companies has been provided vide Notification No. 07/2021- Central Tax dated 27.04.2021 for period upto 31.05.2021.”

To read the tweet CLICK HERE.