HSN code now mandatory for all businesses and service providers from 01.04.2021 | List of HSN and SAC code by CBIC | SAC code for Chartered Accountant

As we had discussed earlier GST department has issued notification making it mandatory for all registered businesses and service provider to mention HSN/ SAC code in it’s invoice.

Now, CBIC has issued notifications for providing HSN and SAC code for businesses and service provider which is as under:

For Goods with even 6 digit HSN: https://t.co/uaAMIrfLVV?amp=1

For Services: https://t.co/rmdg3L56jb?amp=1 and https://t.co/zIybVE9iHL?amp=1

For 6 digit SAC code of Service: https://t.co/zIybVE9iHL?amp=1

It is important to note that the above notifications includes code which are amended till date/ latest amendments from original notification.

To read CBIC tweet CLICK HERE.

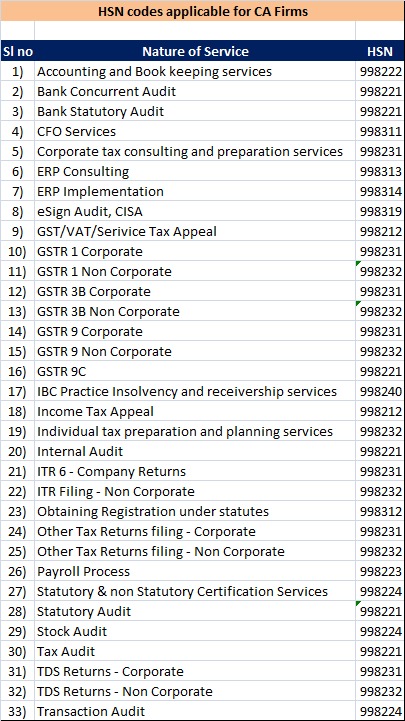

Below are few codes for Tax practitioners and Chartered Accountants for the services being provided by them:

Penalty of INR 50,000/- (INR 25,000/- each for CGST and SGST) can be levied for non-mentioning or mentioning wrong HSN/ SAC Code under Section 125 of the Central Goods and Services Tax Act, 2017 (i.e., General penalty). So do choose correct code.

Penalty of INR 50,000/- (INR 25,000/- each for CGST and SGST) can be levied for non-mentioning or mentioning wrong HSN/ SAC Code under Section 125 of the Central Goods and Services Tax Act, 2017 (i.e., General penalty). So do choose correct code.