Now CA can get details of forms which have not been validated on e-filing website till 10.03.2021 in their UDIN website profile | Due date 31.03.2021

UDIN was a system generated so that only authenticate Chartered Accountants can certify and issue various certificates.

Earlier a Chartered Accountant had to only generate UDIN on website and issue the same. However, later on with Income tax forms it was told that a CA need to also validate such UDIN on e filing website or else the form submitted would be considered as invalid.

The Chartered Accountant and ICAI have been trying a lot so that same could be regularized and everything is in place and for the same ICAI had extended the due date for validating the UDIN till 31.03.2021 issued on or before 10.03.2021.

In this regard earlier CBDT used to send messages to clients that UDIN for some forms issued by their Chartered accountant are not validated and hence same would be considered as invalid if it’s UDIN is not validated.

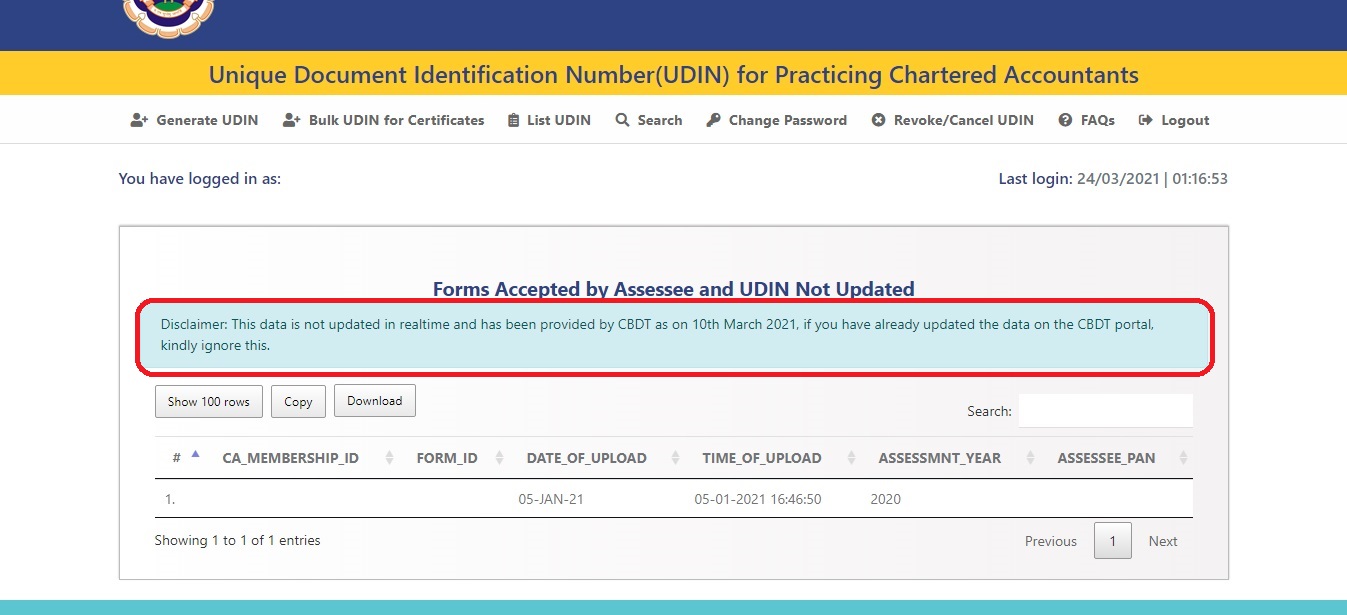

However, now CBDT has shared such information with ICAI and same is available on UDIN website and once you login to UDIN website you will see a pop up as below if any of your issued form is not validated.

Once you click on the above hyperlink as mentioned it will take you to a page where all the forms signed and submitted by you on e filing website will be available along with assessee’s name as can be seen in below image:

Although the CA membership no., form ID and Assessee PAN have been erased in above picture for security purpose but when you will open your ID you can find all details and then based on the above information find the above form and validate the same before the due date i.e. 31.03.2021.

Do remember as mentioned above that the details are based on details available with ICAI and received from CBDT on 10.03.2021 if after 10.03.2021 you have validated the above forms on e filing website you can ignore this message.

So, do validate all the forms before 31.03.2021 or all the forms which are issued by you and not validated will be considered as invalid by CBDT and this could harm your client and your relationship with client.