Who will be considered as Resident individual after amendment in Budget 2020?

There was a confusion relating to the definition of resident as per section 6 when same was announced in Budget 2020 on 01.02.2020 wherein according to that a person of Indian origin is not liable to tax in any other country then such person would be deemed resident in India.

According to this definition all the people working in UAE or such tax heaven countries were worried that they will have to pay tax in India on income earned in UAE. However same was later clarified via a circular wherein it was said that genuine people doing job outside India won’t be covered under this.

Now as people were trying to understand this amendment, Finance ministry again made some amendment in this section 6 when the budget was presented in Lok sabha. Now, if we sum up all the changes there have been mainly 3 amendments which are as under:

1. “In clause (1), in Explanation 1, in clause (b), for the words “substituted” occurring at the end, the words

“substituted and in case of the citizen or person of Indian origin having total income, other than the income from foreign sources, exceeding fifteen lakh rupees during the previous year, for the words “sixty days” occurring therein, the words “one hundred and twenty days” had been substituted,

2. After clause (1), the following clause shall be inserted, namely:––

“(1A) Notwithstanding anything contained in clause (1), an individual, being a citizen of India, having total income, other than the income from foreign sources, exceeding fifteen lakh rupees during the previous year shall be deemed to be resident in India in that previous year, if he is not liable to tax in any other country or territory by reason of his domicile or residence or any other criteria of similar nature.

3. In clause (6), in sub-clause (b), for the words ‘‘days or less’’ occurring at the end, the following shall be substituted, namely:—

‘‘days or less; or

(d) a citizen of India, or a person of Indian origin, having total income, other than the income from foreign sources, exceeding fifteen lakh rupees during the previous year, as referred to in clause (b) of Explanation 1 to clause (1), who has been in India for a period or periods amounting in all to one hundred and twenty days or more but less than one hundred and eighty-two days; or

(e) a citizen of India who is deemed to be resident in India under clause (1A).

Explanation.—For the purposes of this section, the expression “income from foreign sources” means income which accrues or arises outside India (except income derived from a business controlled in or a profession set up in India).”

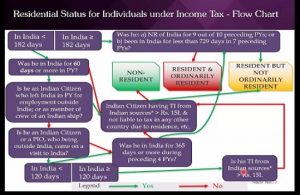

If we include the above amendment in the original provisions we can conclude that a person would be a resident in India if:

1. If he stays in India for 182 or more than days in previous year or

2. If he stays in India for 60 or more days in previous year and 365 or more days in preceding 4 previous years.

Provided that:

(i) In case of a citizen who leaves India as a member of crew of Indian ship or for employment purpose then 60 days in point 2 above shall be substituted for 182 days.

(ii) A person who is citizen of India or a person of Indian origin who stays outside India but comes to visit India in that case also 60 days shall be substituted for 182 days and in case of such person earning more than 15 lakh total income other than income from foreign source, 60 days shall be substituted for 120 days.

[Note: In a situation where 60 days are substituted for 182 days then one will not be required to check the requirement for 365 days as one automatically fall in condition 1]

A new sub section 1A is inserted after this according to which:

An individual, being a citizen of India, having total income, other than the income from foreign sources, exceeding fifteen lakh rupees during the previous year shall be deemed to be resident in India in that previous year, if he is not liable to tax in any other country or territory by reason of his domicile or residence or any other criteria of similar nature.

Now this is a very strict section and people are again in fear that their global income will be taxed in India. However we need to understand that if a person becomes resident in India because of earning more than 15 lakh in India then such individual will only be resident but not ordinary resident.

In such case as discussed in our earlier article only three types of income would be taxed in India:

1. Income received or deemed to be received in India or

2. Income Accrue/ arising or deemed to accrue/ arise in India or

3. Income (other than above) earned outside India from Business or profession wholly controlled from India.

Therefore even if you are working in Dubai and earn more than 15 lakh in India and become resident in India then in that case also your Dubai salary won’t be taxable in India.

A person would be said to be a “not ordinary resident” if:

1. He has been a non resident for nine out of ten previous years, preceding this year or

2. He has been in India for a period of 729 days or less during 7 previous year, preceding this years or

3. He has become a resident by virtue of Sub section 1A above or

4. He has become resident after fulfilling the condition of 120 days in second proviso, however he has been in India for less than 182 days.

Therefore, after considering the above amendment we can conclude that a person who becomes resident by virtue of earning more than 15 lakhs in India, he shall always remain not ordinary resident unless he fulfills other conditions.

This article is just for information purpose it is always advisable to hire a professional for practical execution. If you need assistance you can ask a question to our expert and get the answer within an hour or post a comment about your views on the post and also subscribe to our newsletter for latest weekly updates.