Functionality to download ITR Acknowledgement and full ITR form For AY 2020-21 and before now available on new e-filing website | E-filing 2.0

We have been talking about the functionalities of the new e-filing website i.e. E-filing 2.0 and slowly slowly new functionalities are being added in the the website.

However, one of the major feature which was missing in the new e-filing website was related to downloading of ITR forms and ITR acknowledgement of previous years i.e. AY 2020-21 and before.

Earlier website used to show that same will be available for download soon and one could only download xml file which would also not work.

Further people were facing many issues as they were not able to download earlier year’s ITR and people had to submit the same to renew their loan and CC limit or even for Visa purpose.

Now, the functionality is available and slowly and gradually basic features are being added in the new website and hence one need to check everyday if some new feature has been added.

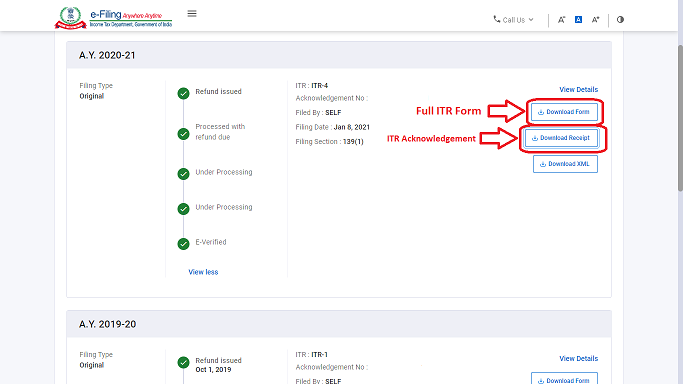

The option to download ITR form would be available after you login into the new e-filing website under E-file -> Income tax return -> View Filed returns.

If you look at the above image you will see that there are two options available:

- Download Form is available for downloading full ITR form.

- Download Receipt to download ITR acknowledgement or ITR-V form.

Now one could even download ITR XML form for even Income tax returns which were filed online directly on website which we believe was not available earlier and this is a good sign.

Note: You might have to click on the above buttons 2-3 times to download the Income tax return and acknowledgement.

However, still there is no functionality to download the ITR intimation issued against the return which was available earlier and hence that also needs to be added fast.

Also, now with new website you can see that on one page very few returns are being displayed which will make people scroll the pages to download earlier income tax returns whereas earlier people were able to see all previous returns on one page.

Further, e filed returns from AY 2013-14 will only be available on this new e-filing website which was not the case earlier as one could see returns filed before that as well. Hence, if you had filed such return online and didn’t save it copy then you might loose that data now.

The functionality for e-proceedings is still coming soon on the new e-filing website which is also a very important functionality.

You can book phone consultation/ assistance online with expert as mentioned below:

To book phone consultation with experts for Income tax CLICK ME.

To book ITR filing with experts CLICK ME.

To book consultation for Faceless Assessment with experts CLICK ME.

To book phone consultation with experts for GST CLICK ME.