How to add CA on new e-filing website for submitting various forms and reports | E-filing 2.0

Under Income tax act, Chartered Accountant’s (CA) have been given various responsibilities to approve and certify various forms and reports like Tax audit forms, Form 15CB etc. Thus, to perform such functions the assessee needs to add and assign the task to such CA in his Income tax profile.

Let’s discuss about the procedure as to how one can appoint a CA on e-filing portal.

The My CA service is available to all registered users of the e-Filing portal who fall under the below categories:

- Individual

- Hindu Undivided Family (HUF)

- Company, Association of Persons (AOP), Body of Individuals (BOI), Artificial Judicial Person (AJP), Trust, Government, Local Authority (LA), Firm

- Tax Deductor and Collector

With this service, registered users will be able to:

- View a listing of their authorized Chartered Accountants (CA)

- Assign forms to a CA

- Withdraw assigned forms

- Activate a CA

- Deactivate a CA

2. Prerequisites for availing this service

- Registered user of the e-Filing portal with valid user ID and password.

- CA should have a valid CA membership number and be registered on the e-Filing portal.

Below is the step by step process to add CA in your Income tax profile.

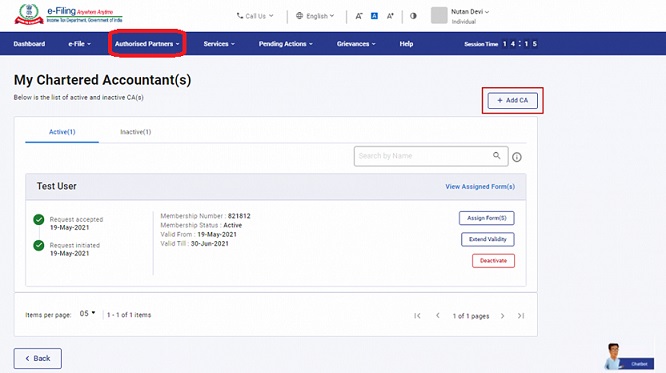

Step 1: For assigning forms to a CA, the CA must be added and authorized by you in your profile. If you want to add a CA, after login to the profile under Authorized partners Click on My Chartered Account(s) and then click Add CA.

Step 2: The Add Chartered Accountant(s)(CA) page appears. Enter the Membership Number of the CA. The CA name is filled automatically from the database.

Step 3: Select the validity period for the CA and click Add.

Step 4: Click Confirm to add the CA.

A success message is displayed along with a Transaction ID. Please keep a note of the Transaction ID for future reference.

Note: CA will be required to accept the request, after which you can assign the form to the CA.

After the CA accept the request you can assign Forms to him.

You can book phone consultation/ assistance online with expert as mentioned below:

To book ITR filing with experts CLICK ME.

To book phone consultation with experts for Income tax CLICK ME.

To book consultation for Faceless Assessment with experts CLICK ME.

To book phone consultation with experts for GST CLICK ME.

To book general phone consultation with expert CLICK ME.