New Process Flow/ Procedure to file Offline or Bulk filing of Form 15CA and Form 15CB on E-filing website | E-filing 2.0

After almost 4 months from the launch of the new e-filing website i.e. E-filing 2.0, Income tax department has on 2nd October i.e. on Gandhi Jayanti has provided the procedure for offline Filing or bulk filing of Form 15CA and Form 15CB.

In a brief Form 15CA and 15CB are used when any person is making a remittance to a non-resident. Reading the below procedure it can be said that the old procedure for submitting Form 15CA and 15CB has been brought back wherein the Chartered Accountant would first file Form 15CB and then based on that the assessee would file Form 15CA and this will be a great relief for many people and make the filing quite easy and smooth.

Now, let’s discuss the new procedure for offline or bulk filing of Form 15CA and Form 15CB as under:

Steps (15CA Offline/Bulk Mode): |

||

| Filing of Form 15CA | ||

| Step | Action by | Action Description |

| Step 1 | Taxpayer | Login to e-Filing portal. Navigate to “e-File” menu and select File Form 15CA under File Forms sub-menu. |

| Step 2 | Taxpayer | On selection of Form 15CA, PAN/TAN of Assessee is auto populated. Provide Financial Year, Filing Type and Submission Mode “Offline/Bulk”. |

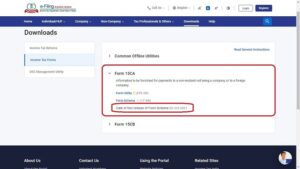

| Step 3 | Taxpayer | Download the Form 15CA Offline Utility. Alternatively, the utility can also be downloaded from “Downloads” section of the Homepage under Income Tax Forms page. |

| Step 4 | Taxpayer | Prepare individual XML’s for Remitter, Remittee and CA (only for Part-C) combination. Zip single/multiple XML’s.

In case of Part-C, the taxpayer has to import XML of Form 15CB submitted by the CA. The submitted Form 15CB XML can be downloaded from View e-Filed Forms functionality post login. |

| Step 5 | Taxpayer | Upload the zip file and submit using prescribed modes of e-verification. A Token Number is generated. |

| Step 6 | Taxpayer | Login to e-Filing portal. Navigate to “e-File” menu and select View Form 15CA Offline/Bulk menu under View Income Tax Forms sub-menu. |

| Step 7 | Taxpayer | The status of each individual XML under the Token Number will be shown as a Success or Failure once the processing is completed. In case an XML is a Success, an Acknowledgement Number is generated for each Form 15CA. Downloadable PDF of Form 15CA will be made available in view filed forms. A valid acknowledgement is also generated for submission of 15CA/CB. |

| Step 8 | Taxpayer | In case of a Failure, no Acknowledgement Number will be generated and reasons for failure will be shown. Re-upload corrected XML file with corrected validations/data after considering reasons for failure. In this case the failed XML can be again zipped and uploaded. Taxpayers are also provided an export option to download the ARN number, processing status, XML file name to identify any failed XML’s. |

Note: Only one Form 15CB Acknowledgement Receipt Number (ARN) can be used for filing one Form 15CA Part-C.

Steps (15CB Offline/Bulk Mode): |

||

| Appointment of CA | ||

| Step | Action by | Action Description |

| Step 1 | Taxpayer | Login to e-Filing Portal. Navigate to “My Chartered Accountant(s)” functionality under Authorised Partners menu. Add CA by providing the Membership Number. Assign Form by selecting Form 15CB, Financial Year and click ‘Add’. This is a one-time appointment to be made every Financial Year. |

| Filing of Form 15CB | ||

| Step 2 | CA | Login to e-Filing portal. Navigate to “e-File” menu and select File Form 15CB under File Forms sub-menu. |

| Step 3 | CA | On selection of Form 15CB, User ID and PAN of CA is auto populated. Provide Filing Type, Submission Mode “Offline/Bulk” and Financial year. |

| Step 4 | CA | Download the Form 15CB Offline Utility. Alternatively, the utility can also be downloaded from “Downloads” section of the Homepage under Income Tax Forms page. |

| Step 5 | CA | Prepare individual XML’s for Remitter, Remittee and CA combination. A zip file containing one XML or multiple XML’s of different taxpayer can be uploaded in the system. There is no limit specified and taxpayer can submit any number of XML’s in a Single Zip File. |

| Step 6 | CA | Login to e-filing Portal. Upload the zip file and submit under Digital Signature Certificate (DSC). A Token Number is generated. |

| Step 7 | CA | Navigate to “e-File” menu and select View Form 15CB Offline/Bulk menu under View Income Tax Forms sub-menu. |

| Step 8 | CA | The status of each individual XML under the Token Number will be shown as a Success or Failure once the processing is completed. In case an XML is a Success, an Acknowledgement Number is generated for each Form 15CB |

| Step 9 | CA | In case of a Failure, no Acknowledgement Number will be generated and reasons for failure will be shown. Re-upload corrected XML file with corrected validations/data after considering reasons for failure. In this case the failed XML can be again zipped and uploaded. Downloadable PDF of Form 15CB in all successful cases will be made available in view filed forms. Taxpayers are also provided an export option to download the ARN number, processing status, XML file name to identify any failed XML’s and enable easy mapping of ARN number to a corresponding 15CA XML. |

Note: Only one Form 15CB Acknowledgement Receipt Number (ARN) can be used for filing one Form 15CA Part-C.

One important change as can be seen above is now people have offline utility for Form 15CA as well which was not available earlier. However, till now no option has been available to validate the UDIN with Form 15CB which was available in earlier website.

Let’s wait and see when the same will be available or the professional will be harassed once again to bulk validate the UDIN at a later date.

The revised Procedure for filing of Form 15CA and Form 15CB has been announced/ Provided by Income tax department Today i.e. 02nd October 2021 and will be made operational on new e-filing website from 04.10.2021 as per the message from CBDT as under:

“Dear Taxpayer, Offline/Bulk Upload of Form 15CA and Form 15CB will be enabled on the portal on 4th Oct’21. Please check News & Updates and Help section for more information.- e-Filing, Income Tax Department”

Further, there has been an update in online submission of Form 15CA and 15CB which will be shared soon.

Although the new offline utility looks similar to old utility but the basic software used is different, hence one should download new utility to file Form 15CA and 15CB. To download the utility CLICK HERE.

To download the full procedure CLICK HERE.

You can book phone consultation/ assistance online with expert as mentioned below:

To book ITR filing with experts CLICK ME.

To book phone consultation with experts for any Income tax related matters CLICK ME.

To book consultation for Faceless Assessment with experts CLICK ME.

To book phone consultation with experts for GST related matters CLICK ME.

To book general phone consultation with expert CLICK ME.