How to register and use digital signature on new e-filing website for a company, partnership firm etc. | E-filing 2.0

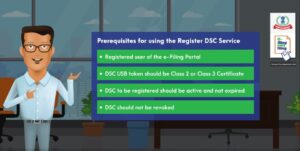

Registering Digital signature on e-filing website is important and necessary especially in case of a company or LLP where digital signature is mandatory in many cases on e-filing website.

Further, one has to now file Income tax return or approve the tax audit report or verify Form 15CA and for that having a digital signature registered on e-filing website is important.

In the earlier e-filing website one could go to the profile of the company or firm and there register the digital signature of the authorized person.

However the system has been changed on the new e-filing website.

Also, the digital signature’s that were registered on the earlier e-filing website were not carried forward on the new e-filing website and it was mentioned that this has been done as a privacy measure. Thus, each and everyone has to again register his/ her digital signature on the e-filing website.

Now, on the new e-filing website the system has changed and for an company or firm or any such type of organization other than individual if they have to verify anything using a digital signature then they have to get the digital signature registered on the e-filing profile of the individual director or partner or member who are authorized to verify the returns or reports.

To read more on how can an individual register digital signature in his e-filing website profile CLICK HERE: How to register Digital signature (DSC) on new e-filing website with Income tax department | E-filing website 2.0 – Taxontips

For eg: Company ABC private limited has two directors A and B and now they wish to file their Income tax return using digital signature of director A, for that the company has to ask Director A to register his digital signature in his person e-filing profile that Mr. A uses to file his Income tax return and then Company ABC Private Limited needs to add Mr. A as key person in the e-filing website profile of ABC private limited and then at the time of adding such person also authorize him as a principal contact and authorize to e-verify.

You can find the key person option as shown in the image below:

Before trying to add details of key person please check if that person is already added in the companies profile.

Once all this is done one would be able to use digital signature in the company to verify any returns or Forms.

Note: Do remember to download the embridge (emsigner) software from the e-filing website before signing/ verifying any document on e-filing website.

You can book phone consultation/ assistance online with expert as mentioned below:

To book ITR filing with experts CLICK ME.

To book phone consultation with experts for any Income tax related matters CLICK ME.

To book consultation for Faceless Assessment with experts CLICK ME.

To book phone consultation with experts for GST related matters CLICK ME.

To book general phone consultation with expert CLICK ME.