Compliance Notice

Compliance notices are different types of notices. These are not regular assessment notices where Income Tax officer issues notices to ask for information about various transactions.

Infact this is one step before that where Income Tax department tells you about some information available with them according to which it asks you be prepared or file return according to that information.

It is issued to the persons who haven’t filed their return of income and where government believes one should have filed return of income or when a person has entered into some high value transaction which he/ she has not reported in their Income Tax return.

Now with advancement of technology and with increase in scope of Form 26AS, SFT government has information about all major transactions that one does.

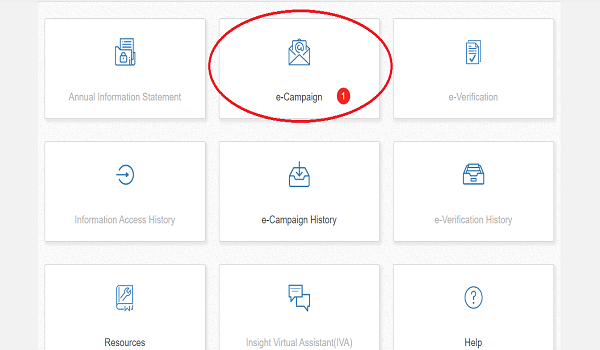

Government has even prepared a separate portal where you can look at the information available with government. To read more CLICK HERE.

Do remember you cannot reply to such notice offline or by writing a letter you need to reply it online. There is no definite way to reply such notice, hence it’s advisable to have a consultant and let him assist you.

You will receive the notice either on your registered e-mail or receive an SMS on registered mobile number.

If you face any issues with booking or making payment feel free to mail us at Support@taxontips.com

Submit Your Documents with receipt