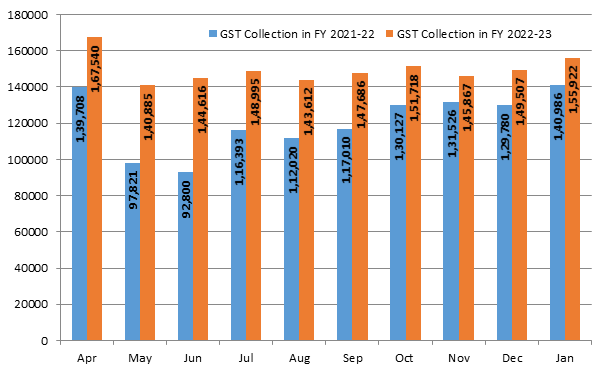

Rs 1,55,922 crore gross GST revenue collected in the month of January 2023

Second highest collection ever, next only to the Rs 1.68 lakh crore gross collection in April 2022

GST collection crosses Rs 1.50 lakh crore mark for the third time in FY2022-23

Revenues in the current financial year upto January 2023 24% higher than the GST revenues during the same period last year.

The gross GST revenue collected in the month of January 2023 till 5:00 PM on 31.01.2023 is Rs 1,55,922 crore of which CGST is Rs 28,963 crore, SGST is Rs 36,730 crore, IGST is Rs 79,599 crore (including Rs 37,118 crore collected on import of goods) and cess is Rs 10,630 crore (including Rs 768 crore collected on import of goods).

The Government has settled Rs 38,507 crore to CGST and Rs 32,624 crore to SGST from IGST as regular settlement. The total revenue of Centre and the States in the month of January 2023 after regular settlement is Rs 67,470 crore for CGST and Rs 69,354 crore for the SGST.

The revenues in the current financial year upto the month of January 2023 are 24% higher than the GST revenues during the same period last year. The revenues for this period from import of goods are 29% higher and from domestic transaction (including import of services) are 22% higher than the revenues from these sources for the same period last year.

This is for the third time, in the current financial year, GST collection has crossed Rs 1.50 lakh crore mark. The GST collection in January 2023 is the second highest next only to the collection reported in April 2022. During the month of December 2022, 8.3 crore e-way bills were generated, which is the highest so far and it was significantly higher than 7.9 crore e-way bills generated in November 2022.

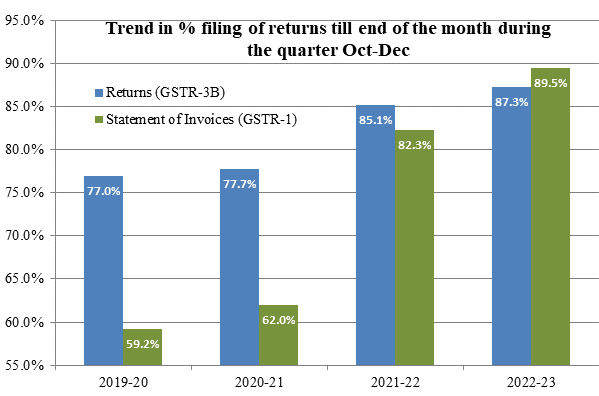

Over the last year, various efforts have been made to increase the tax base and improve compliance. The percentage of filing of GST returns (GSTR-3B) and of the statement of invoices (GSTR-1), till the end of the month, has improved significantly over years. The trend in return filing in the Oct-Dec quarter over last few years is as shown in the graph below. In the quarter Oct-Dec 2022, total 2.42 crore GST returns were filed till end of next month as compared to 2.19 crore in the same quarter in the last year.

This is due to various policy changes introduced during the course of the year to improve compliance.

The chart below shows trends in monthly gross GST revenues during the current year.

To read Press Release CLICK ME.

![[Live] Updates and Tax changes for Budget 2023 | Tax on cryptocurrency | Income tax and GST udpates in Budget 2023 [Download Bill]](https://www.taxontips.com/wp-content/uploads/2023/02/Budget-2023-75x75.webp)