A few days ago we had posted an article wherein we had discussed as to how GST website only keeps your data for 3 years and now we have again come across another glitch or inaccuracy of GST website which is as under:

If you go to return dashboard in your GST portal and then select any month and year, (in our example we have chosen March 2019) you will find a tab with the name “Comparison of Liability declared and ITC claimed”

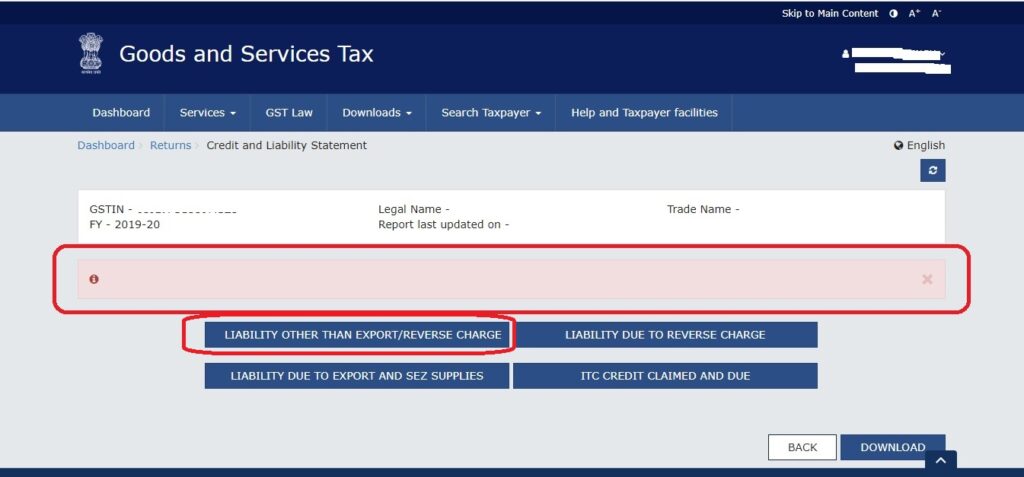

When you click on “View” a new page would be loaded but there you will see a red pop-up which is sign of some kind of glitch or imperfection in the website and when you click on any of the tab. Let’s says we click on “Liability other than export/ reverse charge”

You will again see a blank screen when you click on any tab which means that either GST website is not storing such data or not preparing such report.

Let’s see whether CBIC will make any changes in future to make this report available to tax payers.

In our last post we had talked about various enhancements in GST portal but there are still lot’s of changes and enhancements required because of such a huge act.

Do comment below whether you checked and faced any issue?