GST news

Reporting of supplies notified under section 9(5) / 5(5) by E-commerce Operator in GSTR-3B w.e.f. 01.01.2022

In light of the above, E-commerce operator and registered person would report taxable supplies notified under section 9(5) of CGST...

Read moreRs 1,29,780 crore gross GST Revenue collection for December 2021

The gross GST revenue collected in the month of December 2021 is Rs 1,29,780 crore of which CGST is Rs 22,578 crore, SGST...

Read moreImportant changes in GST law effective from 01.01.2022

Below are some important changes which shall take place in GST law w.e.f. 01.01.2022 with regard to GST rates, GST...

Read moreExisting GST rates in textile sector to continue beyond 1st January, 2022 | 46th GST council meeting

Earlier there was notification issued according to which GST rates for majority of goods and services under textile sector was...

Read moreDue date for GSTR 9/ 9C for FY 2020-21 extended till 28.02.2022 [Read notification]

The due date for furnishing annual return in FORM GSTR-9 & self-certified reconciliation statement in FORM GSTR-9C for the financial...

Read moreInput Tax credit limit restricted to the ITC available in GSTR 2A from earlier additional ITC of 5% over and above ITC in GSTR 2A

According to above amendment one more condition has been added to section 16 of CGST act, which deals with Input...

Read moreOfficers Of Directorate General Of GST Intelligence (DGGI), Ahmedabad With The Support Of Officers Of Local Central GST Initiated Search Operations In Kanpur

In the premises of the transporter, M/s Ganpati Road Carriers, more than 200 fake invoices used in the past for transportation of...

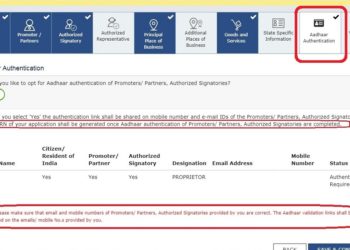

Read moreMandatory Aadhaar authentication for person Registered under GST

In the said rule, it is mandatory for the registered person to undergo Aadhaar authentication for the below purposes, Filing...

Read moreE-commerce Operator (Zomato, Swiggy) are liable to pay GST under reverse charge on restaurant service provided through their platform u/s 9(5)

ECOs are not the recipient of restaurant service supplied through them. Since these are not input services to ECO, these...

Read moreModule wise new functionalities deployed on the GST Portal for taxpayers deployed in November 2021

New functionalities deployed on GST website for the month of November affects below mentioned modules: Registration Refund, Registration, returns and...

Read moreImprovements in GSTR-1 return from 26.11.2021

A revamped & enhanced version of GSTR-1/IFF is being made available on the GST Portal to improve the taxpayer experience....

Read moreGST Revenue collection for November 2021 | ₹ 1,31,526 crore gross GST revenue collected in the month of November 2021

₹ 1,31,526 crore gross GST revenue collected in November GST collection for November,2021 surpassed last month collection registering the second...

Read moreGross GST Collection in FY 2021-22 shows increasing trend

Giving out the Gross Direct Tax collection figures for the FY 2021-22, the Minister stated that as on 23.11.2021 Gross...

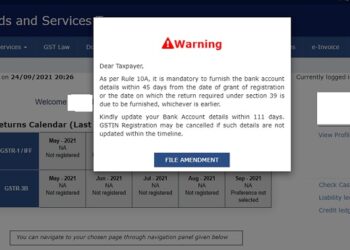

Read moreAdding/ Submitting bank details mandatory on GST website or else GST registration will get cancelled

In India GST was introduced in July, 2017 and there are various turnover and other conditions which needs to be...

Read moreIncrease in GST rate on job work charges of dyeing and printing on Textile products from 01.01.2022

Thus, after the above notification the job work service of dyeing and printing on the textile yarn and fabric has...

Read more