News

Submit response to confirm/ revise the refund claim – Why are you getting this mail and how to get refund

Your income-tax return has been identified under risk management process of the Income-Tax Department. In this context, your confirmation is...

Read moreStatutory Compliance Calendar for August 2022 | Income tax, GST and various other laws

Statutory Compliance Chart for the Month of August 2022 : Below mentioned are some important due dates under Income tax, GST, company...

Read moreClarification on spending of CSR funds for “Har Ghar Tiranga” campaign

it is clarified that spending of CSR funds for the activities related to this campaign, such as mass scale production...

Read moreDRI detects Customs duty evasion of Rs. 2,217 crore by M/s. Vivo Mobile India Pvt. Ltd.

This mis-declaration resulted in wrongful availment of ineligible duty exemption benefits by M/s Vivo India, amounting to Rs 2,217 crore....

Read moreSingle Click NIL filing of GSTR-1

It has been constant endeavor to improve the user experience and performance of GSTR-1/IFF filing and hence significant improvements in...

Read moreTurnover limit for E-invoicing reduced to Rs. 10 crore from Rs. 20 crore [Read notification]

In the said notification, in the first paragraph, with effect from the 1st day of October, 2022, for the words...

Read moreTime limit for verification of ITR reduced from within 120 days to 30 days of filing of ITR electronically

4. It has been decided that in respect of any electronic transmission of return data on or after the date...

Read moreRent earned from property situated outside India by assessee resident in India cannot be taxed in India – Delhi ITAT

Hon’ble ITAT has mentioned that the word “may” cannot be considered as “shall”, and hence passed on a judgement that...

Read moreSimplified regulatory framework for e-commerce exports of jewellery through courier mode

A simplified regulatory framework for e-commerce exports of jewellery through courier mode has been issued on 30.06.2022 by the Central...

Read moreITR 6 is now available for filing | What are the changes in ITR 6 for AY 2022-23 | File ITR 6 online with experts on Taxontips

This Return Form can be used by a company as per section 2(17) of the Income Tax Act. This form...

Read moreIntroducing new Table 3.1.1 in GSTR-3B for reporting supplies u/s 9(5)

2. A new Table 3.1.1 is being added as per Notification No. 14/2022 – Central Tax dated 05th July, 2022...

Read moreFAQs on GST applicability on ‘pre-packaged and labelled’ goods released by CBIC

Certain representations have been received seeking clarification on the scope of this change, particularly in respect of food items like...

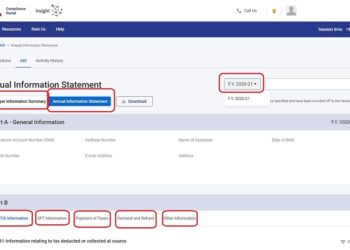

Read moreFAQ’s on AIS (Annual Information Statement) issued by Income Tax Department

AIS is the extension of Form 26AS. Form 26AS displays details of property purchases, high-value investments, and TDS/TCS transactions carried...

Read moreGST needs to be charged on hotel room upto Rs. 1000 also | Now GST will be charged on renting room in Hospital

Thus, now any hotel room, guest house, club or campsite is rented same will be liable for atleast 12% GST.

Read moreNow GST needs to be paid on renting residential property under reverse charge | Effective from 18.07.2022

However, now the government has amended the provisions with regard to renting of residential property wherein by way of Notification...

Read more