In India we have seen a lot of drama going around cryptocurrency where it was once banned by RBI in India and then Supreme court passed an order to cancel the ban imposed by RBI wherein people could invest in cryptocurrency. RBI’s reply on ban on dealing in cryptocurrencies after Supreme court’s order – Taxontips

After this we had informed our readers that in the budget session a bill for banning other private cryptocurrency has been laid so that RBI can bring it’s own digital currency but due to some reason that bill could not be discussed then. Cryptocurrency bill will be introduced in Parliament to ban other cryptocurrency in India – Taxontips

Now, it is being said that in the winter session of parliament (which will begin from 29.11.2021, government of India is ready to present the cryptocurrency bill by the name of “The cryptocurrency and regulation of official digital currency bill, 2021” wherein the intention of the bill is as under:

“To create a facilitative framework for creation of the official digital currency to be issued by the Reserve Bank of India. The bill also seeks to prohibit all private cryptocurrencies in India, however, it allows for certain exceptions to promote underlying technology of cryptocurrency and its uses”

Thus, this bill will have two agenda:

- To bring RBI’s own digital or cryptocurrency.

- To ban all private cryptocurrency in India except few which are providing some technology as well.

After this news we had even seen a big downside in cryptocurrency’s value locally wherein the prices had fallen at around 20-25% and later recovered. However form the intention we can say that various cryptocurrencies such as dogecoin, bitcoin etc could be banned as they don’t have any underlying technology whereas ethereum, binance etc could survive as they even have a technology business to support their cryptocurrency.

It is also being said that this bill will not be presented in the initial days of winter session as the bill is still under preparation but it will be presented in Winter session only.

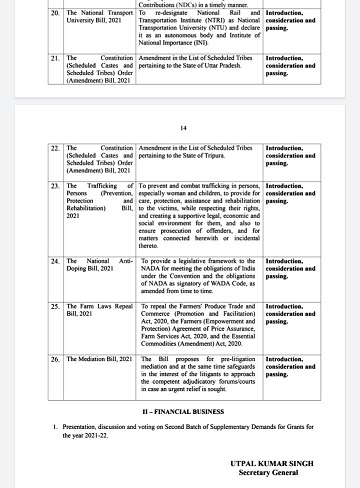

Various other bills which will be presented in winter session includes agricultural bill for which our Hon’ble PM had made announcement and in total there are 26 bills which can be seen as under:

Please share your Thoughts on the above bills in Comments below.

You can book phone consultation/ assistance online with expert as mentioned below:

To book ITR filing with experts CLICK ME.

To book phone consultation with experts for any Income tax related matters CLICK ME.

To book consultation for Faceless Assessment with experts CLICK ME.

To book phone consultation with experts for GST related matters CLICK ME.

To book general phone consultation with expert CLICK ME.

Comments 1