The Institute of Chartered Accountants of India (ICAI) is the national professional accounting body of India. It was established on 1 July 1949 as a statutory body under the Chartered Accountants Act, 1949 enacted by the Parliament (acting as the provisional Parliament of India) to regulate the profession of Chartered Accountancy in India. ICAI is the second largest professional Accounting & Finance body in the world.

Also, ICAI is nothing but an organisation made up of group of Chartered Accountants who are member of this organisation. ICAI gives recognition to the Chartered Accountant and also authority to sign Financial statements of various organisation, also an organisation needs fund from its member to function for which an annual fees needs to be paid by the members.

There are two types of members:

1. Practicing CA: Who are members of ICAI as well as holding Certificate of practice.

2. Industry CA: Who are just members of ICAI and are in job in industry.

In members also there are two types of members:

1. ACA: Associate members

2. FCA: Fellow members.

Fees to be paid by a CA to ICAI depends on the combination that he falls in. You can read about the fees structure by Clicking Here: https://www.icai.org/new_post.html?post_id=12517 and the fees structure for members holding or not holding COP is reproduced hereunder:

Fees for all Members not holding Certificate of Practice |

|||||||||||||||

|

Rs.1,770/- |

||||||||||||||

|

Rs.3,540/- |

||||||||||||||

Fees for all Members holding Certificate of Practice |

|||||||

|

Rs.5,310/- |

||||||

|

Rs.8,260/- |

||||||

ICAI is promoting “I GO GREEN with ICAI” scheme under which Member opting e-journal will be given a discount of Rs.590/- (including 18% GST) on total amount of Membership Fees.

Now, let’s understand how you can pay your fees for year 2021-22 (Last date for payment of membership fees for 2021-22 is 30.09.2021):

ICAI had launched SSP portal last year after which ICAI went 100% paperless and all its working was done online. Therefore to pay your membership fees you need to first register on SSP portal by clicking here: https://eservices.icai.org/ which is as under:

Next after mentioning your log in credentials you’ll land at the home page there you need to choose Click here to access SSP portal:

Next you need to Click on 2019 Pay now/ give consent as highlighted in the image below.:

(2019 here signifies that last membership fees paid was for year 2019-20.

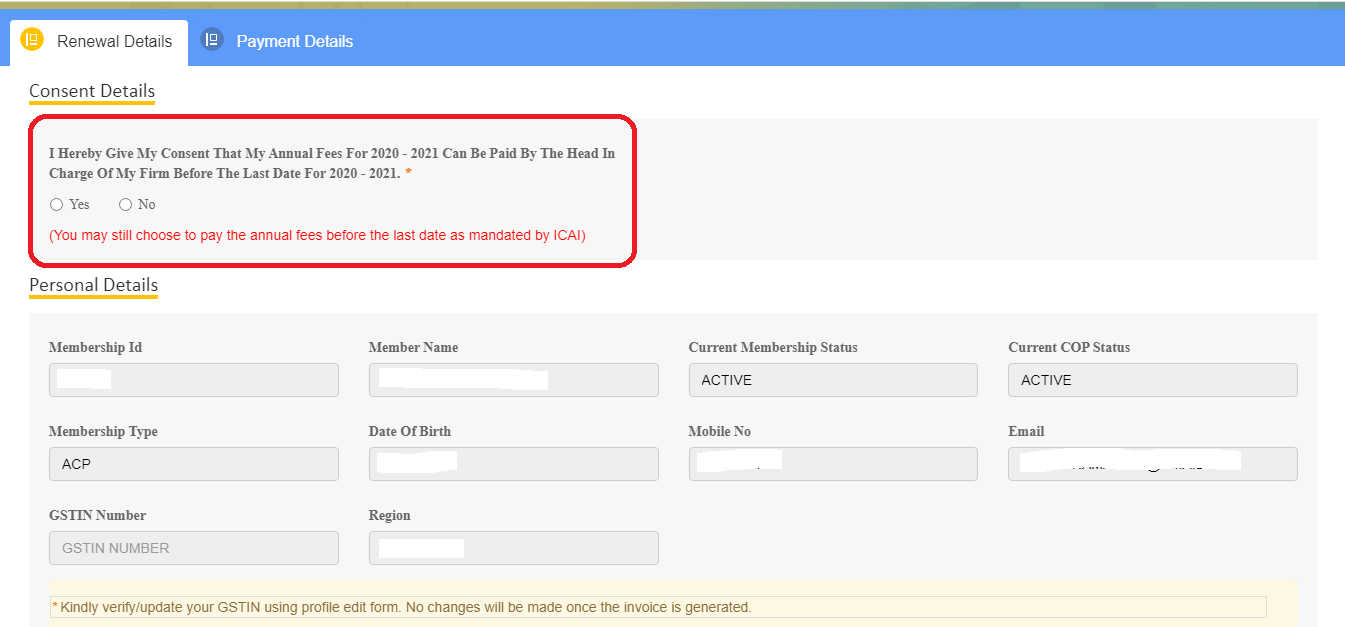

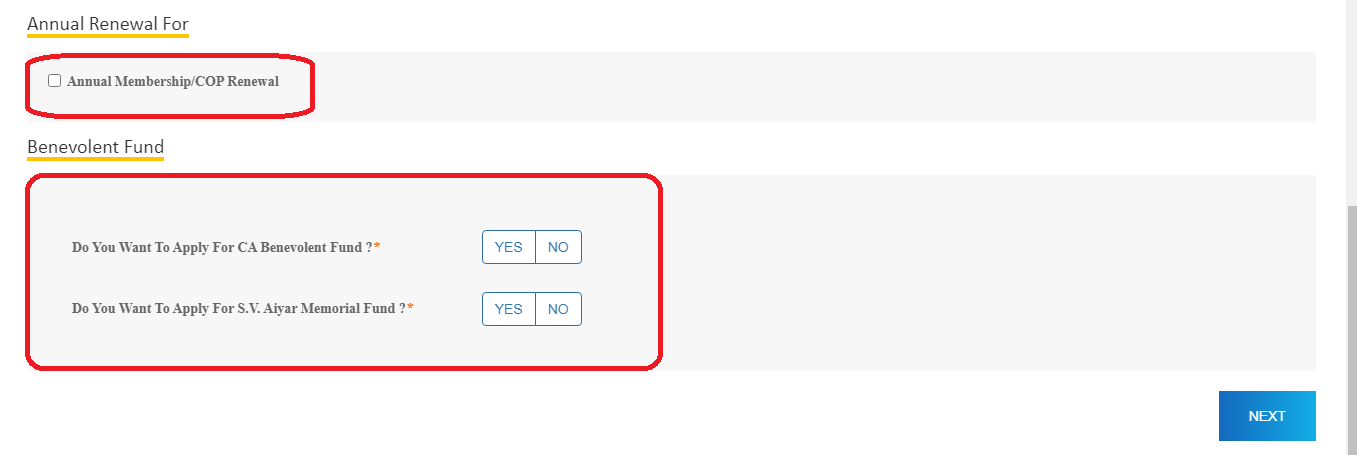

Next you would be first ask to give consent to the head in charge of your firm if you are registered as a partner or paid assistant of a firm. As now ICAI has enabled bulk payment system where head of a firm can make bulk payment for all members of his ICAI registered with him firm in one go. However if no payment is made till last date you can still make your individual payment.

After choosing the relevant option above you can click on next and you will be redirected to the payment page where you will see breakup of fees one needs to pay. Below is the breakup of one of the ACA member of ICAI holding COP for your example:

After clicking next you will be redirected to a payment gateway managed by Paytm, where you can choose from various options of payment like: Paytm, Credit card, debit card, net banking etc.

After making a successful payment a pop up would appear as below showing transaction id etc and then the last membership paid will change from 2020 to 2021 as shown in first image.

You can even pay fees in bulk for future years.

In case of any issues or discrepancy you can always write your query at: https://help.icai.org/

Comments 2