Yesterday late fee for filing of GSTR 3B for period mentioned in Notification 52/2020 was waived conditionally vide notification 57/2020.

Thus, after the above notification if someone files GSTR 3B after original due date but upto 30.09.2020 then late fees charged shall be Nil in case of Nil GSTR 3B and it shall be capped at Rs. 500 (Rs. 250 CGST and Rs. 250 SGST) in any other case.

However, it again raised a question of whether government is punishing law compliant people and those who are paying late fees and paying late fees and helping those who are not doing timely compliance of law.

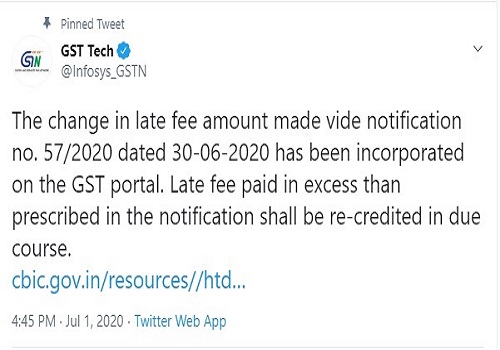

But this time as we can see in the above image, GST Tech i.e. official twitter handle to handle IT related queries on GST has tweeted that:

“The change in late fee amount made vide notification no. 57/2020 dated 30-06-2020 has been incorporated on the GST portal. Late fee paid in excess than prescribed in the notification shall be re-credited in due course.”

This is going to be the first time that GST department will refund the excess late fees paid. As we know notification 57/2020 was notified on 30.06.2020 but with retrospective effect from 25.06.2020 and hence if anyone has paid any late fees between 25.06.2020 to 30.06.2020 same shall be refund as the new late fees was implemented on 30.06.2020.

It is important to note that here it has been said that “same shall be re-credited.” Now whether same shall be re-credited in cash account or credit account is not clear here, as one need to pay late fees in cash and ITC cannot be used for payment of late fees. So lets see whether refund of excess late fees will be in cash ledger or credit ledger.

There is no exact date as to when such amount shall be refunded or no notification has been issued in this regard, however it’s a good sign that such a thing has been atleast accepted in the public domain.

Now, people are confused whether they will get excess refund for just Feb period or for all late fee from inception i.e. July 2017 as relaxation in regard to same has also been provided.

However, it is important to note that here GST Tech has talked only about late fees waived in 57/2020, and accordingly just the excess late fees paid for Feb 2020 return by tax payer having turnover above Rs. 5 crore shall be refunded.

People are still waiting for any refund of excess late fees paid for GSTR 3B of period between July, 2017 to Jan, 2020.