Recently on 31.01.2020 due date for GSTR 9 was extended in a staggered manner.

The CBIC said that, “Considering the difficulties being faced by taxpayers in filing GSTR-9 and GSTR-9C for FY 2017-18 it has been decided to extend the due dates in a staggered manner for different groups of States to 3rd, 5th and 7th February 2020 as under. Notifications will follow.”

“Group 1: Maharashtra, Karnataka, Goa, Kerala, Tamil Nadu, Puducherry, Telangana, Andhra Pradesh, Other Territory – 3rd February 2020

Group 2: Jammu and Kashmir, Himachal Pradesh, Punjab, Chandigarh, Uttarakhand, Haryana, Delhi, Rajasthan, Gujarat- 5th February 2020

Group 3: Bihar, Sikkim, Arunachal Pradesh, Nagaland, Manipur, Mizoram, Tripura, Meghalaya, Assam, West Bengal, Andaman & Nicobar Islands, Jharkhand, Odisha, Chhattisgarh, Dadra and Nagar Haveli and Daman and Diu, Lakshadweep, Madhya Pradesh, Uttar Pradesh- 7th February 2020″

The above list was again changed on 03.02.2020 and was again distributed in 2 groups wherein:

“Chandigarh, Delhi, Gujarat, Haryana, Jammu and Kashmir, Ladakh, Punjab, Rajasthan, Tamil Nadu, Uttar Pradesh, Uttarakhand – 5th February 2020.” were in Group 1 and

“Manipur, Meghalaya, Mizoram, Nagaland, Odisha, Puducherry, Sikkim, Telangana, Tripura, West Bengal, Andaman and Nicobar Islands, Andhra Pradesh, Arunachal Pradesh, Assam, Bihar, Chhattisgarh, Dadra and Nagar Haveli and Daman and Diu, Goa, Himachal Pradesh, Jharkhand, Karnataka, Kerala, Lakshadweep, Madhya Pradesh, Maharashtra, Other Territory, – 7th February 2020” were in group 2.

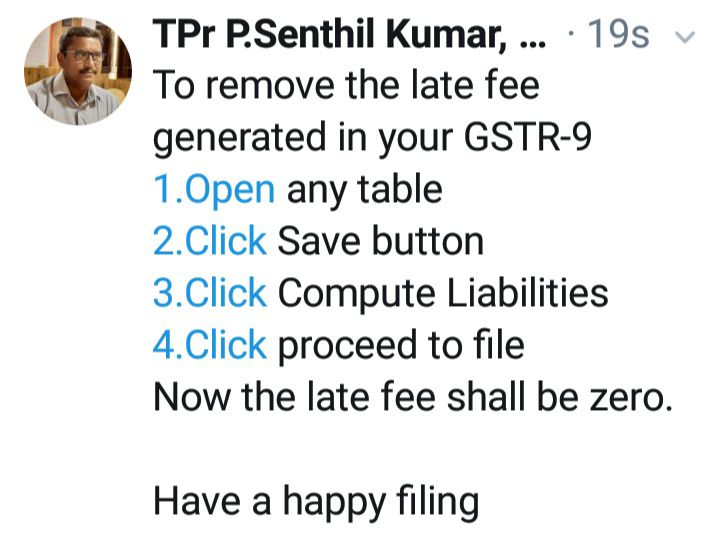

Now even after the extension when people are filing their GSTR 9 its showing penalty of late fees and hence people are confused on how is late fees getting calculated when there is still time for the due date as the first due date is 5th February.

However its a system error and hence many people are writing a grievance to the system and asking for a probable. Well, here is a probable solution you can use to get rid of late fees and file your GSTR 9.

One more issue that many professionals are facing is that when they are trying to file GSTR 9C it shows that GSTR 9 has not been filed when it has been already filed or sometimes it doesn’t generate ARN for such GSTR 9 filed and they are getting confused on how to deal with such system failure situation.

The best solution for now would be to file a grievance and second take screenshots of all system failure and attach the same with a letter to your jurisdictional officer stating you have been trying to file return but it is not getting accepted along with physical copy of your returns. There are situations where he would refuse to accept it then it is advised to send the letter through Registered Post A.D. so that you have a proof of such receipt and it will be helpful for you in further litigation, if any.

If you need assistance you can ask a question to our expert and get the answer within an hour or post a comment about your views on the post and also subscribe to our newsletter for latest weekly updates.