CBDT vide its order under section 119 have increased the time limit for filing of Income tax return by any assessee u/s 139(1) for A.Y. 2019-20 till 31.01.2020 in the Union Territory of Jammu and Kashmir and Union territory of Ladakh.

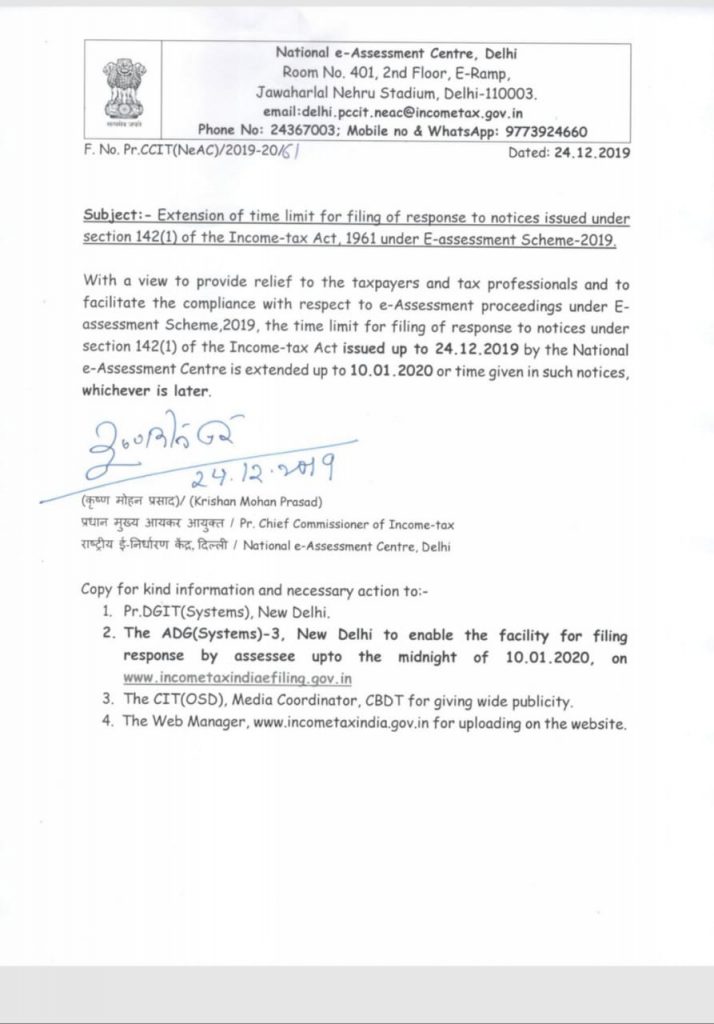

Also CBDT vide its another circular has extended the time limit for reply of any notices issued till 24.12.2019 under the new faceless assessment proceedings till 10.01.2020. As earlier it was decided that any notices issued under such new scheme needs to be complied within 15 days, however since this system is new CBDT has extended the time limit for once.

If you need assistance you can ask a question to our expert and get the answer within an hour or post a comment about your views on the post and also subscribe to our newsletter for latest weekly updates.