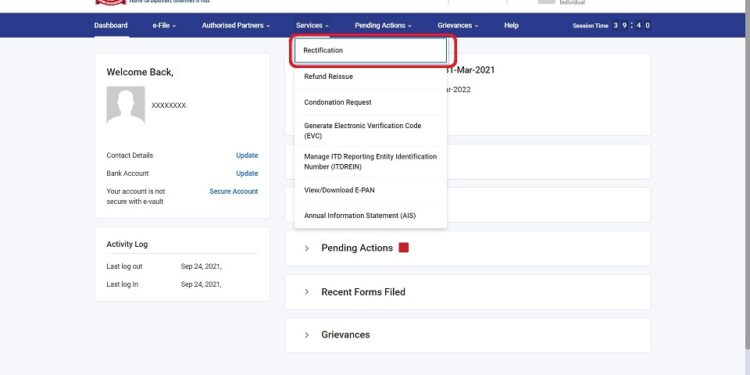

As we had discussed Income tax department had started only two types of rectification request on the new e-filing portal i.e. E-filing 2.0. To read more CLICK HERE: Option to File Rectification Request under section 154 of Income tax act for Income tax return option now available on new e-filing website | e-filing 2.0 – Taxontips

Now, Income tax website has added a few more options such as uploading xml of return which needs to be reprocessed. Hence, it is a welcoming step that Income tax department is adding new features regularly.

In this post let’s discuss about few FAQ in relation to filing of rectification request on the e-filing portal i.e. E-filing 2.0.

1. When do I need to submit a rectification request?

A request for rectification can be submitted on the e-Filing portal if there is any mistake apparent from record, in an Intimation issued u/s 143(1) or order u/s 154 by the CPC or by the Assessing Officer (where rectification rights are transferred by CPC) . A rectification request can be submitted only for returns that are already processed by CPC.

2. What kinds of errors can be corrected by submitting a rectification request?

You can submit a rectification request for errors in the processing of your income tax return by CPC. Only mistakes apparent from record is considered for rectification, such as:

- Total Tax Liability: For example, tax payments not matched as per the CPC order, cancellation of adjustment of earlier demand, variance in interest/tax computation, amending assessment order or intimation

- Gross Total Income: For example, income chargeable under any head wrongly considered, salary income not matched, brought-forward losses not been allowed, incorrect set-off of current year losses, amending assessment orders, re-computing total income for succeeding year(s) in respect of loss or depreciation, withdrawing investment allowance, re-computing deemed capital gains.

- Total Deductions: For example, details of deductions under Chapter VI-A wrongly considered, MAT/MATC or AMT/AMTC not allowed/partially allowed, amending assessment order to allow deduction for late remittance of foreign exchange.

- Personal Information: For example, requesting to tax at slab rates for partners information of e-filed return, gender of taxpayer wrongly considered/gender updated in PAN database, reduction of tax rate as domestic instead of non-domestic company, date of filing of original return is taken as not within the due date, reduced claim of taxpayer income governed by Portuguese Civil Code, requesting change of residential status, or that the income shown in the return is not taxable as the assessee is a society registered u/s 12A or is a non-resident.

The above categories cover all types of taxpayers registered on the e-Filing portal. Do not use rectification request for changing bank account or address details in your ITR, or any other mistake on your part which can be corrected with a revised return.

3. What are the different request types for income tax rectification?

- Reprocess the Return

- Tax Credit Mismatch Correction

- Additional Information for 234C Interest

- Status Correction (applicable to ITR-5 and ITR-7, applicable till AY 2018-19)

- Exemption Section Correction (applicable to ITR-7 only, applicable till AY 2018-19)

- Return Data Correction (Offline)

- Return Data Correction (Online)

Note: For Return Data Correction (Offline), taxpayers needed to upload XML generated in the offline utility till AY 2019-20, but can upload JSON and submit rectification online from AY 2020-21.

4. What are the different request types for wealth tax rectification?

- Reprocess the Return

- Tax Credit Mismatch Correction

- Return Data Correction

Note: Rectification of wealth tax return can be submitted for AY 2014-15 and AY 2015-16 only.

5. Why can rectification for wealth tax return be filed only for AY 2014-15 and AY 2015-16? What should I do for AYs after that?

The Wealth Tax Act has been abolished w.e.f 28th February 2015 (i.e., A.Y.2015-16). So, rectification of wealth tax return can be filed for AY 2014-15 and AY 2015-16 only. To rectify wealth tax return for Return Data Correction, use Upload Form BB in response to a notice for assessment.

6. I want to file a rectification against an intimation u/s 143(1) from 5 years ago. Why is the system not allowing it?

You are not allowed to file rectification request after the expiry of 4 years from the end of the FY in which the intimation u/s 143(1) was passed.

7. I had e-Verified my income tax return using DSC and am trying to e-Verify my rectification request using EVC. Why is the system not allowing it?

If you had e-Verified your ITR through DSC, you need to e-verify your rectification request using DSC. Your DSC should be registered with e-Filing, active, and not expired. If not, you will be taken to the Register / Update Digital Signature Certificate (DSC) page to register / update it.

8. Can I rectify my previously filed ITR using the rectification request service?

If you notice a mistake in your submitted ITR, and it has not processed by CPC, you can submit a revised return. You can use the rectification request service on the e-Filing portal only against an order/notice from CPC.

9. Who can apply for rectification request?

Only these parties who get the order / notice u/s 143(1) from CPC can apply for rectification request on the e-Filing portal:

- Registered taxpayers

- ERIs (who have added client PAN)

- Authorized Signatories and Representatives

10. Can I submit a rectification request on e-Filing in case of manual / paper filing of return?

No, the Rectification Request service on the e-Filing portal does not cover the submission of rectification for paper filed returns. You need to submit a rectification request with your AO in paper mode.

11. Can I submit a rectification request on e-Filing in case rectification rights are transferred to AO?

No, the Rectification Request service on the e-Filing portal currently does not cover rectification in case of rights transferred to AO. In such a case, you need to approach your AO with the rectification application on paper.

12. Can a rectification request be withdrawn or filed again, once submitted?

No, you are not allowed to withdraw rectification requests already submitted. You can file another rectification request only after the submitted one is processed in CPC.

13. Can I claim exemptions/deductions when submitting a rectification request?

No. You are not allowed to claim new deductions / claims / tax credits.

14. There is a change in my income/bank/address details, which I need to update in my ITR. Should I file a rectification request?

Rectification request is not applicable for a change in income / bank / address details. Your income details can be updated through a revised return. You can update personal details (such as bank / address details) on the e-Filing portal using the Service Request service, and selecting Change ITR Particulars. Enter the acknowledgement number of the ITR and submit.

15. Up to which AYs in the past can a rectification request be filed online?

There is no specific AY till when rectification can be submitted online, it depends on the particular case. However, rectification request can be submitted within 4 years from the end of the financial year in which the order sought to be amended was passed.

16. Which number should I quote from the order when filing for a rectification request?

You need to quote to CPC Order No./ Intimation No. / DIN of the latest filed ITR. This is auto-populated and non-editable for Income Tax, and editable for Wealth Tax.

17. I am required to be audited u/s 44AB. Is DSC compulsory for me when filing a rectification request?

Yes, DSC is mandatory for those people audited u/s 44AB who are filing a rectification request.

18. I uploaded the wrong details in my rectification request. How do I correct it?

You cannot submit a revision of the rectification request, neither can you withdraw it. Once submitted, you can file another rectification request after the submitted one is processed in CPC.

19. I have paid the demand raised by CPC. Do I have to file a rectification request to cancel the demand?

No. The demand will get adjusted automatically by the payment you made.

20. I filed my original ITR post the due date (belated return). I need to revise the submitted ITR. Can I file a rectification request?

No – Rectification of ITRs are different from filing a revised return. You can revise your belated return (applicable only from FY 2016-17 onwards) either before the end of the following FY, or before the processing of the ITR by tax authorities, whichever comes first. A rectification request can only be filed in response to a notice / order / intimation from CPC for a specific e-Filed return.

21. I originally filed ITR-1. Can I use ITR-2 when responding to the CPC notice with a rectification request?

No, you will need to use ITR-1 if that’s what you filed originally.

22. I am a salaried individual taxpayer. Can I use EVC when submitting a rectification request? What other options do I have?

Yes, you can use EVC. If not using EVC, you can use DSC.

23. Can an appeal be filed against a rectification order?

Yes. You can file an appeal directly to the CIT(A) against an intimation order issued by CPC.

24. While submitting my rectification request, I am getting an error message – Incorrect details. Please enter details as per the latest order. What should I do?

Check whether you entered the correct CPC Order No./ Intimation No. / DIN. The system validates whether the CPC Order number is the latest one as received from CPC. If it’s not, you will get this error message.

25. I want to file for rectification because of gender mismatch and not correction of data. What should I do?

First, make sure you have updated your gender correctly in the PAN database. When filing for rectification, if you have no further correction of data, you can opt for Reprocess the Return, and select the gender mismatch checkbox. You won’t need to submit a return XML/JSON in such a case.

You can book phone consultation/ assistance online with expert as mentioned below:

To book ITR filing with experts CLICK ME.

To book phone consultation with experts for any Income tax related matters CLICK ME.

To book consultation for Faceless Assessment with experts CLICK ME.

To book phone consultation with experts for GST related matters CLICK ME.

To book general phone consultation with expert CLICK ME.