New E-filing website was made available in June, 2021 but not all the features were activated on the e-filing website. The features are getting activated slowly on the new e-filing website.

After filing the Income tax return, the return gets processed by Central Processing Centre i.e. CPC, after which it issues an intimation order under section 143(1).

An intimation is issued whether or not there is any variation in Income as calculated by CPC and as mentioned by assessee in his Income tax return.

If there is any variation reported by CPC, an assessee has two options i.e. either to apply for rectification under section 154 of the IT Act or to file appeal before CIT(A) for the same.

As per section 154, Income tax authority can pass rectification order against the below mentioned order:

(a) amend any order passed by it under the provisions of this Act ;

(b) amend any intimation or deemed intimation under sub-section (1) of section 143;

(c) amend any intimation under sub-section (1) of section 200A;

(d) amend any intimation under sub-section (1) of section 206CB.

Thus, as per clause (b), Income tax authority have the power to rectify the intimation issued under section 143(1) of the Income tax act.

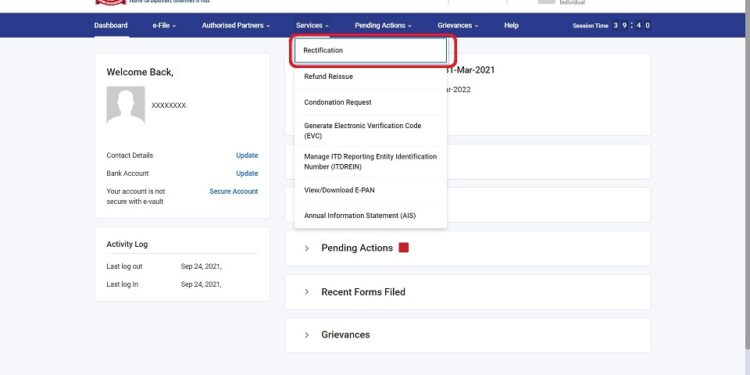

Till now, for filing rectification against intimation issued under section 143(1) a person had to apply for the same online before CPC but in the new website such facility is not available but now the same has been made available under the tab “Services” as can be seen above.

To apply for rectification one has to first log-in to the e-filing portal then under the tab “Services”, they need to select for rectification as can be seen in image above.

After selecting for rectification a window will appear wherein the Individual has to raise a “New request” as can be seen in the image below to apply for new rectification.

After clicking on “New request”, you will have to the Assessment year for which rectification request needs to made and after choosing the assessment year one needs to Click on continue and submit the request.

It is pertinent to note here that as of now one could apply for rectification on the Income tax portal only to reprocess the Income tax return and not for any other purpose.

Therefore, as of now rectification cannot be filed for uploading updated xml or for any other reason.

Further, as of now rectification request against assessment order issued under Faceless Assessment can be filed before Local Assessing officer and not online.

Hence, if you just wish to apply for rectification of Income tax return to reprocess your Income tax return you can do that now on the New e-filing portal.

You can book phone consultation/ assistance online with expert as mentioned below:

To book ITR filing with experts CLICK ME.

To book phone consultation with experts for any Income tax related matters CLICK ME.

To book consultation for Faceless Assessment with experts CLICK ME.

To book phone consultation with experts for GST related matters CLICK ME.

To book general phone consultation with expert CLICK ME.

Comments 2