The Income Tax Department (‘ITD’) has started an 11 day E-campaign from 20th July 2020 upto 31st July 2020. The aim of this campaign to encourage voluntary compliance and reduce number of scrutiny assessments.

Two groups will majorly be targeted under this initiative:

a. The non-filers of returns, in particular for A.Y. 2019-20.

b. Those who have filed their returns but the IT Department has identified discrepancies (such as High Value Transactions that do not commensurate with the Return Filed).

In our earlier Post’s we have discussed how can one reply to compliance notice issued by ITD. Now we shall discuss a few FAQ issued by ITD with regard to compliance notice.

Below are a few FAQ provided by Income Tax Department (ITD) relating to compliance portal:

1. If the information displayed in the issue does not belong to me, what should I do?

A. In that case, you can select the response “Not aware of this information” and click on the Submit button. Your feedback will be sent to the information source for confirmation.

2. If the information displayed does not belong to me, but it belongs to a related person, what should I do?

A. In such a case, you can select the response “Aware of this information” and click on the Submit button. You can provide the details of the related person under the section “Relates to other PAN/year”

3. If the information amount displayed is not correct, how do I mention the correct amount?

A. If the information value displayed is not correct, please mention the correct value while submitting the response. Such cases may be sent to the information source for confirmation.

4. Can I submit a response in a letter?

A. Response is required to be submitted online only.

5. Which internet browser should I use to view and submit response on compliance portal?

A. The compliance portal and other utilities can be best viewed on Internet Explorer 11 and latest version of browsers like Mozilla and Chrome.

6. What if I am legally not liable to file return of income? (Now many people have this question that my income is below 2.5 lakh and I am not liable to file return even after considering the transaction as I had incurred a loss in that transaction.)

A. Step 1: Login to the e-filing portal by using the URL https://incometaxindiaefiling.gov.in/

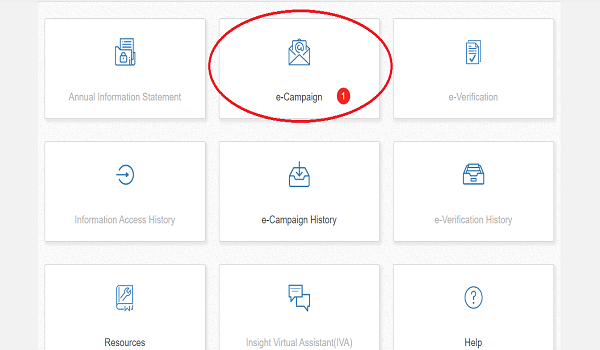

Step 2: Click on the ‘Compliance Portal’ link available in “My Account” or “Compliance” tab.

Step 3: Click on e-verification tab

Step 4: Click on View button against the case.

Step 5: Select response as “ITR has not been filed.”

Step 6: Select reason as “Not liable to file return of income.”

Step 7: Submit the response.

Step 8: Once you submit the response, issues will be visible.

Step 9: Navigate to each issue by clicking on view.

Step 10: Under each issue related information(s) will be visible. Submit response for each related information.

Note: For guidance on filing response for each information, please refer user guide available in resources section in compliance portal.

7. If I have already filed return, what should I do?

A. Step 1: Login to the e-filing portal by using the URL https://incometaxindiaefiling.gov.in/

Step 2: Click on the ‘Compliance Portal’ link available in “My Account” or “Compliance” tab.

Step 3: Click on e-verification tab

Step 4: Click on View button against the case

Step 5: Select response as “ITR has been filed”

Step 6: Select Mode i.e. e-filed or Paper filed

Step 7: Enter Date of submission of return and acknowledgement number received after submission of return of income. In case of paper filed return, Circle/Ward and City is also to be entered.

Step 8: Submit the response.

8. Once submitted, if I want to modify or change my response or explanation provided?

A. You can edit/revise the submitted response anytime.

To read full FAQ CLICK HERE.