CBDT vide notification 35/2020 dt. 24.06.2020 had extended due date for filing belated and revised return for FY 2018-19 till 31.07.2020.

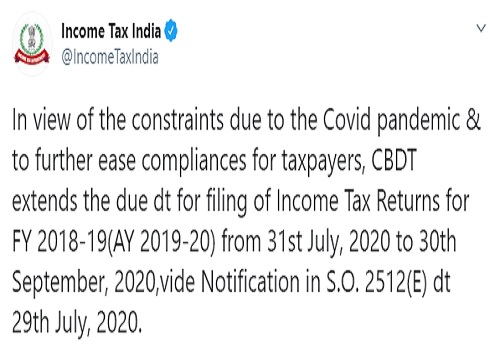

Now, vide notification 56/2020 Dt. 29.07.2020, CBDT has made 2 changes:

1. Extended the due date for filing belated and revised return for FY 2018-19 i.e. AY 2019-20 upto 30.09.2020.

2. Provided relief for senior citizen wherein any tax paid by them till 31.07.2020 shall be considered as advance tax for the purpose of second proviso of earlier notification for interest u/s 234A.

As per the second proviso of notification 35/2020 it was mentioned that extension of due date shall not be applicable to calculation of 234A and hence while calculating tax liability under 234A for interest only the following deduction shall be allowed from total tax liability i.e.

(i) advance tax, if any, paid;

(ii) any tax deducted or collected at source;

(iia) any relief of tax allowed under section 89;

(iii) any relief of tax allowed under section 90 on account of tax paid in a country outside India;

(iv) any relief of tax allowed under section 90A on account of tax paid in a specified territory outside India referred to in that section;

(v) any deduction, from the Indian income-tax payable, allowed under section 91, on account of tax paid in a country outside India; and

(vi) any tax credit allowed to be set off in accordance with the provisions of section 115JAA or section 115JD.

Therefore no deduction of self assessment tax is allowed for such 234A calculation.

Let’s take an example that if Mr. A who is non senior citizen, his total tax liability comes to Rs. 5 lakh and he has paid advance tax of Rs. 3.5 lakh and till july he pays Rs. 1 lakh and pays remaining tax while filing the return of Income, then in that case as per the proviso since the total tax liability after reducing advance tax and TDS is Rs. 1.5 lakh which is more than 1 lakh he shall be liable to interest u/s 234A of the Income Tax act of whole 1.5 lakh.

In the same example if Mr. A is a senior citizen tax paid by him till 31st July 2020 shall be considered as Advance tax and hence deductible from total tax liability for calculation of 234A interest and hence he shall not be liable for interest u/s 234A as total tax liability would be below Rs. 1 lakh.

Thus, in case of senior citizen if any tax is paid before 31.07.2020 and remaining tax payable is below 1 lakh no interest u/s 234A shall be charged.

To read full notification CLICK HERE.

![[Live] Updates and Tax changes for Budget 2023 | Tax on cryptocurrency | Income tax and GST udpates in Budget 2023 [Download Bill]](https://www.taxontips.com/wp-content/uploads/2023/02/Budget-2023-350x250.webp)

![[Live] Updates and Tax changes for Budget 2023 | Tax on cryptocurrency | Income tax and GST udpates in Budget 2023 [Download Bill]](https://www.taxontips.com/wp-content/uploads/2023/02/Budget-2023-120x86.webp)

Comments 1