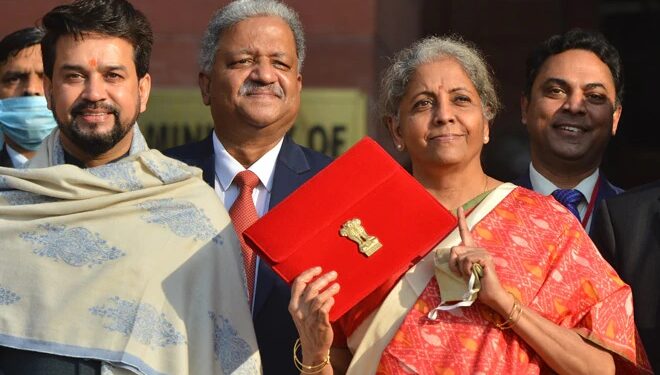

Every year our Hon’ble Finance Minister presents Finance bill in the parliament through which necessary amendments are made to the Income tax act and various other acts.

Finance bill or budget was presented in Parliament on 01.02.2021 and has been finally passed in both the houses of parliament and is now an Act from 28.03.2021. Let’s have a clause by clause look at the important amendments made by Finance Act, 2021 to the Income tax act:

1. Goodwill of business or profession has been categorically removed from definition of block of asset i.e. section 2(11)(b).

2. Unit linked insurance policy not covered under section 10(10D) due to applicability of 4th and 5th proviso are now covered under definition of capital asset under 2(14) i.e. such ULIP policy is now a capital asset.

3. “Liable to tax” is now defined under Income tax act in clause 29A to section 2 as under:

““liable to tax”, in relation to a person and with reference to a country, means that there is a liability of tax on such person under the law of that country for the time being in force and shall include a person who has subsequently been exempted from such liability under the law of that country;”

This definition has been changed from the definition proposed in first Finance Bill presented on 01.02.2021.

With introduction of this definition it will be easy to judge taxability of person under section 6(1A) i.e. deemed resident.

4. Slump sale meaning u/s 2(42C) has been changed from “transfer of undertaking as a result of the sale” to “transfer of undertaking by any means” and same shall increase scope of slump sale transaction and now slump sale by way of exchange will also be covered and now paying cash consideration is not necessary.

5. ULIP policy shall now be taxable: Amendment has been made to section 10(10D) whereby if one or more than one ULIP policy issued after 01.02.2021 and whose individual or aggregate yearly premium is above Rs. 2.5 lakh, proceeds from such policy/ policies won’t be exempt u/s 10(10D).

Provided that such amendment won’t be applicable on proceeds received on death of a person and hence amount received on death of a person will still be exempt.

6. Interest earned and proceeds earned from provident fund now not exempt: Section 10(11) and 10(12) deals with income from provident fund wherein it has been mentioned such exemption shall not be available where contribution made on or after 01.04.2021 is exceeding Rs. 2.5 lakh.

Further in case where contribution is made to a fund only by employee and not by employer the above limit shall be increased to Rs. 5 lakh instead of 2.5 lakh.

7. No depreciation on goodwill: Now goodwill has been categorically removed from definition of intangible asset and now no depreciation can be charged on goodwill of business or profession be it self generated goodwill or even purchased goodwill.

8. Explanation in section 36(1)(va) for employee contribution to ESI EPF fund: Earlier there were various case laws wherein people have taken due date mentioned u/s 36(1)(va) as due date mentioned u/s 43B. However, now CBDT has passed a clarification vide explanation 2 wherein it has been clearly mentioned that due date mentioned in section 36(1)(va) is not the due date mentioned u/s 43B and it has been amended in such a way as if it was applicable retrospectively.

Similar amendment has been made in section 43B.

9. Amendment in section 43CA: The allowable difference between sale price and stamp duty value for transaction covered under 43CA has been increased to 20% from existing 10% for sale between the period 12.11.2020 to 30.06.2021 along with some other conditions.

Simultaneous amendment has been made to section 56 for purchaser.

10. Tax audit limit u/s 44AB increased: Tax audit limit has been increased for business from Rs. 5 crore (increased in last Budget 2020) to Rs. 10 crore. The above limit is applicable only if conditions mentioned in proviso are fulfilled.

11. Amendment in section 44ADA: Section 44ADA has been amended to exclude LLP’s from taking benefit of this section. This is just a theoretical amendment as before this also practically LLP could not file ITR 4.

12. New section 45(1B) for taxability of ULIP plans: As mentioned above various ULIP plans shall not be exempt u/s 10(10D) of the Income tax act and hence it’s taxability is covered specifically under 45(1B) where tax on same shall be calculated in the year in which amount is received.

13. Amendment in section 50 relating to goodwill: In a case where goodwill of a business or profession

forms part of a block of asset for the assessment year beginning on the 1st day of April, 2020 and depreciation thereon has been obtained by the assessee under the Act, the written down value of that block of asset and short term capital gain, if any, shall be determined in such manner as may be prescribed.

14. Amendment to section 50B slump sale: Wherein from 01.04.2021 fair market value of capital asset instead of book value shall be considered for slump sale. Amendment is as under:

“‘(2) In relation to capital assets being an undertaking or division transferred by way of such slump sale,—

(i) the “net worth” of the undertaking or the division, as the case may be, shall be deemed to be the cost of acquisition and the cost of improvement for the purposes of sections 48 and 49 and no regard shall be given to the provisions contained in the second proviso to section 48;

(ii) Fair market value of the capital assets as on the date of transfer, calculated in the prescribed manner, shall be deemed to be the full value of the consideration received or accruing as a result of the transfer of such capital asset.’;

(b) in Explanation 2, after clause (a), the following clause shall be inserted, namely:—

“(aa) in the case of capital asset being goodwill of a business or profession, which has not been acquired by the assessee by purchase from a previous owner, nil;”

15. Time limit for section 54GB extended: Time limit mentioned u/s 54GB for investment in start up has been extended from 31.03.2021 to 31.03.2022.

16. Taxability of ULIP plans u/s 112A: The ULIP plans mentioned above shall be liable to tax u/s 112A at the rate of 10%.

17. Amendment to time limit for filing of return of income u/s 139: Due date for filing return of income of individual whose spouse is a partner in a firm whose accounts gets audited, due date for same would also be 31st October.

Due date for filing revised and belated return would now be 31st December of the relevant assessment year instead of 31st March.

18. Amendment to time limit mentioned u/s 143: Time limit for processing return has been reduced from 12 months to 9 months.

Scope of processing of return of income has been increased u/s 143(1).

19. Amendment in section 147, 148 and 149 and insertion of new section 148A. We shall update you with a detailed article on the above sections. Read about notice u/s 148 in our latest article.

20. Time limit for completing assessment proceedings under Income tax act has been amended u/s 153 of the Income tax act.

21. New TDS section 194P: TDS on senior citizen where they earn only pension and interest income. After above amendment eligible senior citizens are not required to file their income tax return.

22. New TDS section 194Q: TDS on sale of goods which is a duplicate section of TCS u/s 206C(1H).

23. Higher TDS and TCS rates for non filers of Income tax return: New section 206AB and 206CCA have been inserted for higher TDS deduction and higher TCS collection respectively in case the purchaser or seller is not filing return of income.

24. Amendment to late fees u/s 234F: Since the due date for filing belated return has been reduced to 31st December above and accordingly late of Rs. 10,000 which was to be paid if return is filed after 31st December has been removed.

25. Penalty for not link Aadhar and PAN: New penalty has been introduced u/s 234H for not linking Aadhar and PAN.

Above are some of the major 25 amendments made in Finance Act, 2021. If you wish to read full Finance Act, 2021 CLICK HERE.

The above amendments shall be soon incorporated in Income tax act available on Income tax India website.

![[Live] Updates and Tax changes for Budget 2023 | Tax on cryptocurrency | Income tax and GST udpates in Budget 2023 [Download Bill]](https://www.taxontips.com/wp-content/uploads/2023/02/Budget-2023-350x250.webp)