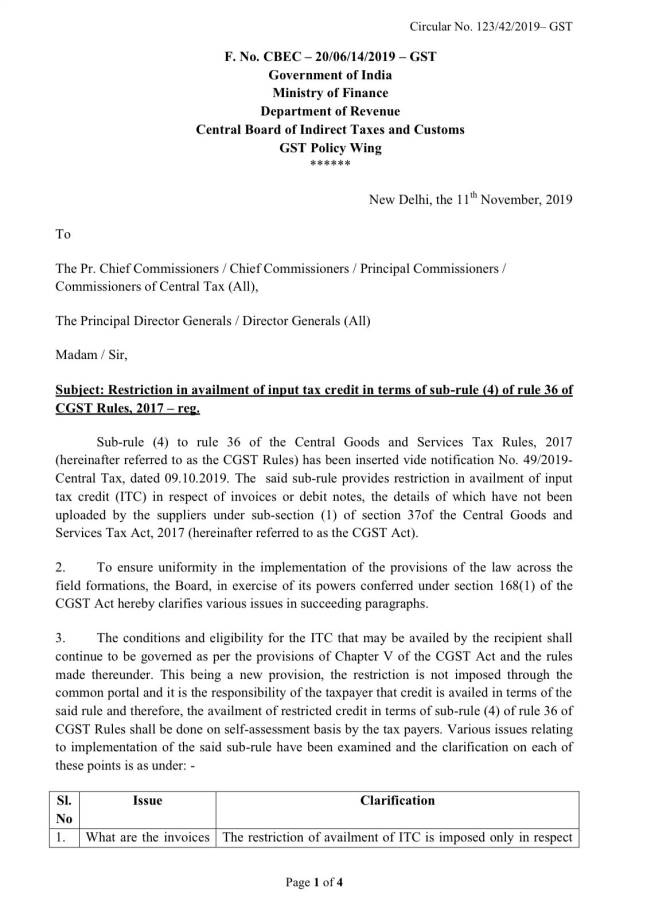

The CBIC has issued following further clarification with regard to claiming of ITC u/s 36(4) for which invoice is not available in GSTR -2A vide circular no. 123/42/2019 Dt. 11.11.2019.

The claiming of ITC is still a manual process and assessee himself needs to calculate the amount which will be available to him as ITC and then match it with GSTR – 2A and the if there are certain invoice which are not available in GSTR – 2A then for he can take 20% of total credit eligible in GSTR 2A or total credit available whichever is higher.

It is important to mention that one can claim 20% of total eligible credit available in GSTR – 2A, which means if you have certain credit in GSTR – 2A but is not eligible or block credit then it won’t be taken into consideration while making the above calculation. CBIC has even clarified that above calculation needs to be done on cumulative basis and not on supplier basis, thus in future if you certain invoices are made available on GST portal by supplier then you can further claim 20% credit on the remaining credit if any available. For eg: In October month you had invoice with Rs. 8000 credit however only Rs. 6000 credit was available in GSTR – 2A. Thus while filing GSTR – 3B for month of October you claimed total credit of Rs. 7,200 (6,000 plus 20% of 6,000). Now in future the supplier again uploads invoice with Rs. 1,000 credit which makes total eligible credit of Rs. 7,000 so now you may claim remaining Rs. 800 credit in the period when Rs. 1,000 credit is available on GSTR 2A.

However, there are still various queries as to how check the above thing in case where the supplier files quarterly GSTR -1 return. Also this system is for temporary purpose and should not be required once new return filing system is implemented.

You can read the full circular as below:

If you need assistance you can ask a question to our expert and get the answer within an hour or post a comment about your views on the post and also subscribe to our newsletter for latest weekly updates.