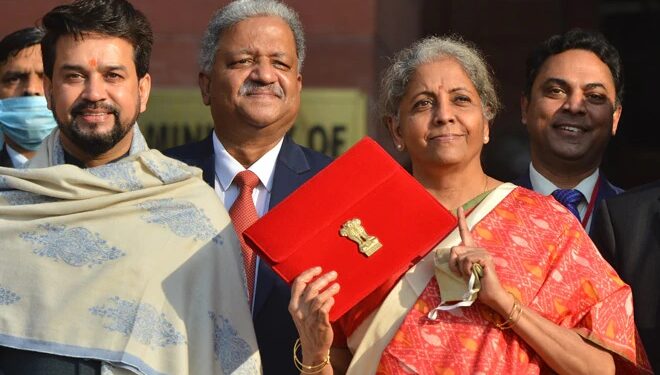

Finance Minister Mrs. Nirmala Sitharaman will present the budget 2022 today i.e. 01.02.2022 in parliament and the budget will start from 11:00 am today.

FM Nirmala Sitharaman and PM Shri Narendra Modi have arrived at the Parliament for Budget 2022.

India’s Digital currency:

RBI to bring Digital Rupee from 2022 and bring India’s own digital currency which will be regulated by RBI and will be based on blockchain technology.

Income tax updates:

New Income tax return format.

Revise return can be filed till 2 years to reduce assessment which will be called as updated return.

Reduce AMT tax rate for co-operative society at 15%.

surcharge rate reduced from 12% to 7% with income of co-operative society between 1 crore to 10 crore.

NPS deduction limit increased from 10% to 14% in case of employee of state and central government.

Benefit of section 115BAB now available for business starting manufacturing till 31.03.2024.

Cap on surcharge on AOP at 15%.

Surcharge on LTCG capped at 15%.

Education cess and surcharge cannot be claimed as business expense.

Brought forward losses cannot be set off against undisclosed income which was found during survey.

Incentive for Start-ups:

Extend the period of incorporation for eligible start up increased from 2022 to 2023 and hence any start up incorporated till 31.03.2023 can now take start-up exemption benefit.

Tax on cryptocurrency:

Profit from #cryptocurrency will be taxed at flat 30% flat without claiming any expense against same and loss from #cryptocurrency shall not be set-off against other income. Further TDS shall be charged on proceeds of digital asset at 1%.

GST:

GST collection for January 2022 is 1.40 lakh crore.

Proposed Amendments:

1. Time-limit to avail ITC u/s 16(4) extended till 30th November of next year from 30th September.

2. Additional Condition for availment of ITC u/s 16(2)- ITC can be availed only if the same is not restricted in GSTR-2B.

3. Composition Tax Payer’s Registration can be cancelled suo-moto if they have not filed their GSTR-4 return beyond 3 months from the due date.

4. Credit Notes in respect of supply made in a financial year can be issued by 30th November of next financial year (currently allowed till 30th September)

5. Any rectification of error in GSTR-1/ GSTR-3B is now permitted till 30th November of next financial year (currently allowed till 30th September).

6. The two-way communication process in filing GST returns is scrapped.

7. The due date for filing return by non-resident taxable person is prescribed as 13th day of next month

8. Section 41 of the CGST Act is being substituted so as to do away with the concept of “claim” of ITC on a “provisional” basis.

9. Section 47 of the CGST Act is being amended so as to provide for levy of late fee for delayed filing of TCS returns.

10. Section 49 of the CGST Act is being amended so as to provide for restrictions for utilizing the amount available in the electronic credit ledger.

11. Section 49 of the CGST Act is being amended so as to allow transfer of amount available in E- cash ledger of a registered person to the E- cash ledger of a distinct person;

12. Section 49 of the CGST Act is being amended so as to provide for prescribing the maximum proportion of output tax liability which may be discharged through the electronic credit ledger

13. Section 50(3) of the CGST Act is being substituted retrospectively, with effect from the 1st July, 2017, so as to provide for levy of interest on input tax credit wrongly availed and utilized. (Meaning thereby Interest will not be levied if ITC is not utilized)

14. Refund claim of any balance in the electronic cash ledger shall be made available.

15. Rate of Interest u/s 50(3) prescribed as 18% in all cases.

To download Finance Bill CLICK HERE.

To download memorandum to Finance Bill CLICK HERE

You can book phone consultation/ assistance online with expert as mentioned below:

To book ITR filing with experts CLICK ME.

To book phone consultation with experts for any Income tax related matters CLICK ME.

To book consultation for Faceless Assessment with experts CLICK ME.

To book phone consultation with experts for GST related matters CLICK ME.

To book general phone consultation with expert CLICK ME.

![[Live] Updates and Tax changes for Budget 2023 | Tax on cryptocurrency | Income tax and GST udpates in Budget 2023 [Download Bill]](https://www.taxontips.com/wp-content/uploads/2023/02/Budget-2023-350x250.webp)

Comments 2