There are various type of assessment/ scrutiny proceedings under Income tax Act, as discussed earlier, and some of which are preliminary assessment, regular scrutiny assessment etc.

Under regular scrutiny assessment also there are various ways in which a case is selected for scrutiny which can be based on CASS (i.e. scrutiny case selected by computer system), manual selection of scrutiny cases (wherein case is selected manually by officer based on some information) or scrutiny selection based on search or seizure.

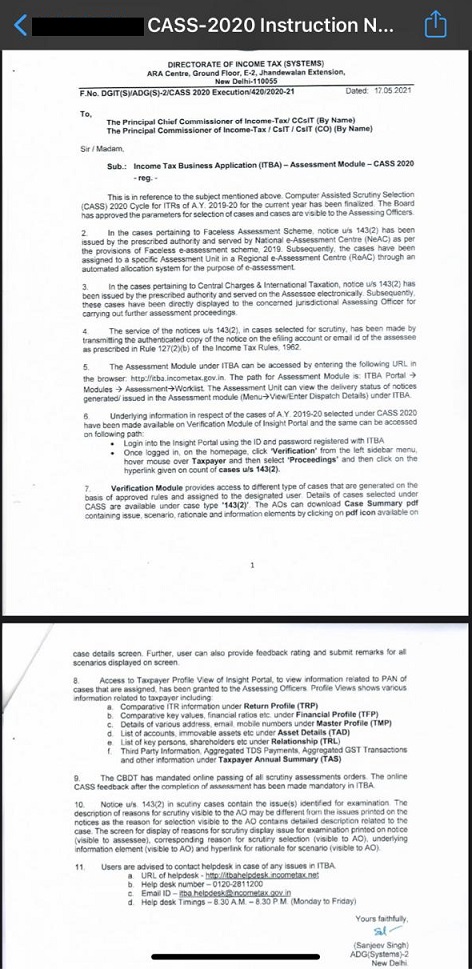

Now, recently CBDT has released instructions to it’s officers that details of cases selected for scrutiny under CASS, 2020 for AY 2019-20 is ready and uploaded on system as the parameters for selection has been finalised and the officers can access the information and send notices to the assessee.

It has been told that assessment will be done online based on the new faceless assessment scheme. You can read the full instructions below:

Since criteria for scrutiny selection has been finalized, assessee’s will start receiving notices for AY 2019-20 within few days.

However the important think to note here is that can Assessing officer issue notice for regular assessment for AY 2019-20 now, as the original due date for issue of notice u/s 143(2) was 30.09.2020 which was further extended to 31.03.2021 by virtue of THE TAXATION AND OTHER LAWS (RELAXATION AND AMENDMENT OF CERTAIN PROVISIONS) Act, 2020 and such extended due date has also expired now.

Further, there was extension of various compliances under Income tax act wherein various due dates were extended upto 30.06.2021 which were applicable only on those compliances for which due date was extended upto 30.04.2021.

CBDT had extended due date only for notices issued u/s 148 of the Income tax act, upto 30.04.2021 from 31.03.2021 by virtue of notification 20/2021 Dt. 31.03.2021 and not for notices of regular assessment. Thus, due date for issuance of notice of regular assessment for AY 2019-20 has expired on 31.03.2021 and now any issuance of notice for regular assessment can be considered as void ab initio.

What do you think ? Under which provision will CBDT issue such notices or is there something which has been missed out? Comment your thoughts below.

Disclaimer: The thoughts mentioned above are the personal views of the author and have no legal binding and Taxontips.com does not hold any liability for the same. Do consult your legal advisor/ tax consultant before taking any decision.