In a case, Calcutta High Court comes hammer & tongs at CAs.

In the latest judgement in Binod Kumar Agarwala vs. CIT, the Hon’ble Calcutta High Court has signaled a zero tolerance policy towards the alleged nefarious practice of CAs.

The High Court slammed the CAs for certifying bogus loans and misleading lenders, which in turn has led to the colossal NPAs.

“The matter is typical of how business is conducted in this country and why loans obtained from banks remain unpaid,” the High Court observed.

The assessee committed fraud on the bank and obtained credit facilities by misrepresenting its financial position.

To aid him in the criminal act, a firm of chartered accountants named ‘Roy Ghosh and Associates’ issued a certified balance sheet containing bogus figures.

The CA firm boldly issued a disclaimer stating that the figures “have no relation with the actual figures”.

“We are giving the information and explanations herewith purely based on estimate basis and have no relation with the actual figures and to avail the bank loan.”, it was stated.

The High Court seethed with anger at the blatant temerity of the Chartered Accountant in certifying the bogus balance sheet.

“The substance of the appellant’s submission is that to suit a person’s purposes before one authority or the other, different pictures as to the financial position of such person or any entity under the control of such person may be presented.

This is a question larger than any legal issue under the Income Tax Act and is a matter of public policy.

It is inconceivable that a person may approach a bank by inflating the value of his assets and a few months down the line he can deflate the value of the assets, so to say, while queuing up to pay tax.”

It is scarcely expected of a banker to question the veracity of any accounts certified by a firm of chartered accountants or to look into the fine print and comprehend therefrom that utterly bogus figures had been furnished only for the purpose of availing of the credit facilities from the bank”, it was observed.

The High Court came down heavily on the practice of painting a rosy picture as to the financial position of the applicant seeking credit facilities while at the same time slipping in another balance-sheet and P&L A/c in the income-tax records indicating a less robust financial position of the constituent.

It described Roy Ghosh and Associates as a “willing accomplice” to this criminal and fraudulent practice.

It also held that the accounts cannot be “tailor-made to suit a particular purpose or window-dressed to make it attractive for bankers to rely thereupon and all the gloss and sheen removed thereafter when it was the time to pay tax.”

ITAT hauled up for not reporting the CA to the ICAI.

The ITAT passed strictures and observed that a Chartered Accountant is governed by certain discipline and he has to conduct audit in accordance with the provisions and rules of the Chartered Accountants Act.

It also noted that Schedule II and Part 1 holds a chartered accountant guilty of professional misconduct if he permits his name or name of his firm to be used in connection with the audit based on estimate.

However, the High Court hinted that the ITAT should have gone further and been vigilant towards the abatement by the CA in the “commission of a colossal act of misrepresentation”.

“Indeed the Appellate Tribunal may only be faulted for not reporting Roy Ghosh and Associates to the Institute of Chartered Accountants for having apparently abetted in the commission of a colossal act of misrepresentation which the appellant assessee undertook before his bankers for the purpose of obtaining credit facilities by indicating a financial position that was not warranted by the books of the assessee”, it held.

Ultimately, the Hon’ble High Court directed that a copy of the order be sent to the ICAI for appropriate steps, if thought fit, to be taken against Roy Ghosh and Associates in accordance with law and upon due notice to such firm of CAs.

ICAI was directed to examine the issue. The ICAI, on the basis of the orders of Hon’ble High Court, issued a show cause notice to the Firm calling upon its explanation in this regard. However, the said Firm of Chartered Accountants have vehemently denied stating that their Firm had not prepared those documents and their signatures and stamp has been forged. The firm had also submitted of having filed a FIR with Khargpur Police and a sworn affidavit affirming their non-association in this matter. However, Director (Discipline), ICAI is further examining the matter.

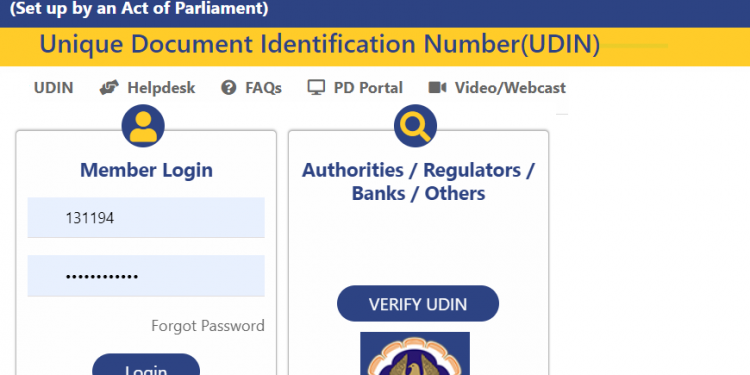

This case was decided before UDIN was introduced, now with UDIN it would be very much difficult for any auditor to deny the certificate issued by him and hence it is advisable to check the certificates twice before issuing.

You can download the entire Order HERE.

This article is just for information purpose it is always advisable to hire a professional for practical execution. If you need assistance you can ask a question to our expert and get the answer within an hour or post a comment about your views on the post and also subscribe to our newsletter for latest weekly updates.

![[Live] Updates and Tax changes for Budget 2023 | Tax on cryptocurrency | Income tax and GST udpates in Budget 2023 [Download Bill]](https://www.taxontips.com/wp-content/uploads/2023/02/Budget-2023-120x86.webp)