GST news

Filing of annual return for FY 2020-21 is optional for Aggregate Annual turnover upto Rs. 2 crore

"In exercise of the powers conferred by the first proviso to section 44 of the Central Goods and Services Tax...

Read moreChanges in GSTR 9 and 9C notified by ministry of Finance for FY 2020-21 | GSTR 9C/ GST audit to be self certified by taxpayer

The Turnover limit for GSTR 9C has been kept at Rs. 5 crore and all businesses with aggregate turnover above...

Read moreNew functionality on Annual Aggregate Turnover (AATO) deployed on GST Portal for taxpayers

GSTN has implemented a new functionality on taxpayers’ dashboards with the following features: The taxpayers can now see the exact...

Read moreFiling of Annual returns by composition taxpayers. – Negative Liability in GSTR-4

In this post we shall discuss about the solution provided by GST department to deal with negative liability in GSTR...

Read moreCBIC extends period of limitation under GST Law in terms of Hon’ble Supreme Court’s Order dated 27.04.2021

is applicable in respect of any appeal which is required to be filed before Joint/ Additional Commissioner (Appeals), Commissioner (Appeals),...

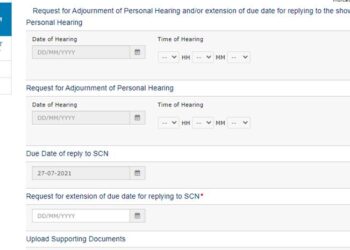

Read moreNow seek adjournment for personal hearing under GST by filing online application using the GSTN portal

It will help filing Adjournment for personal hearing already fixed and enables the next personal hearing. The officer has to...

Read moreImportant changes related to QRMP Scheme implemented on the GST Portal for the taxpayers

Few important changes related to QRMP Scheme implemented on the GST Portal for the taxpayers are as given below: A....

Read moreGST day celebration by CBIC, special gift to taxpayers by CBIC on 4th GST day

As an acknowledgment, the Central Board of Indirect Taxes and Customs will be issuing certificates of appreciation to these taxpayers....

Read moreGST website provides functionality to report misuse of PAN in GST registration | Know step by step process

To address the complaint related to misuse of PAN for obtaining GST registration, a functionality to register such complaints on...

Read moreInterest not fully waived i.e. conditional waiver of interest even after relaxation of GST return due date | Must read

Further, although late fees has been waived for GSTR 3B but still interest could be charged if tax not paid...

Read moreNew functionalities added on GST portal for tax payers | GST update

As part of our constant endeavour to provide a smooth and hassle free experience to the taxpayers and simplify the...

Read moreIssue with PDF preview of GSTR 1 – Table 12 showing ‘0’ instead of “N.A.” – GST dept. clarifies

GSTR-1 for the tax period of May 2021, the ‘Total Invoice value’ field in the preview PDF is displaying a...

Read moreKey Recommendations on GST rates in 44th GST council meeting | Covid-19 related relief in GST

The 44th GST Council met under the Chairmanship of Union Finance & Corporate Affairs Minister Smt Nirmala Sitharaman through video...

Read moreExtension in dates of various GST Compliances for GST Taxpayers for GSTR 1, NRI taxpayers, TDS, TCS etc

Government has extended the dates of various compliances by Taxpayers under GST vide Notn No 12/2021-CT, dated 1st May, 2021, r/w Notn...

Read moreSection 50 of the CGST Act now amended to charge interest on net cash liability retrospectively from 01.07.2017

"In exercise of the powers conferred by sub-section (2) of section 1 of the Finance Act, 2021 (13 of 2021)...

Read more