The GST portal has now enabled the service to Request for an adjournment for Personal Hearing under the Goods and Service Tax (GST).

It will help filing Adjournment for personal hearing already fixed and enables the next personal hearing. The officer has to select the date and time and issue a personal hearing notice.

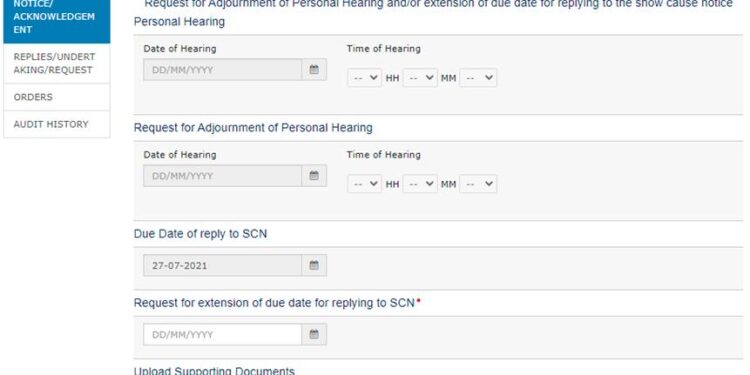

Adjournments are limited to a maximum of three times. The request can be filed by logging in the GST portal and filling up the details namely date of hearing and time of hearing for personal hearing, request for an adjournment for personal hearing, the due date to reply to the Show Cause Notice, request for extension of the due date for replying to the Show cause notice and upload the supporting documents.

A wonderful functionality has been introduced by GSTN on the common portal through which both adjournment and extension of time for furnishing replies can be sought for. Let’s see how this works out and should be available to everyone soon.

Do let us know if you have used it.

You can book phone consultation/ assistance online with expert as mentioned below:

To book ITR filing with experts CLICK ME.

To book phone consultation with experts for Income tax CLICK ME.

To book consultation for Faceless Assessment with experts CLICK ME.

To book phone consultation with experts for GST CLICK ME.