News

Requirement for Fresh registration of trust under section 12AB has been extended till 01.04.2021

Section 12AB was introduced by Finance Act, 2020 and was supposed to be applicable from 01.06.2020 which was later extended...

Read moreClarification issued by CBIC regarding aut populated figures in GSTR 9/ 9C for FY 2018-19

Vide notification No. 69/2020 – Central Tax, dated 30.09.2020, the due date for furnishing of the Annual Return for the...

Read moreImpact of e-Invoicing on Businesses- Simplified & Effective Reconciliation ensured!

Introduction e-Invoicing under GST has been implemented by the Government on large enterprises from October 1st, 2020. Businesses are...

Read moreICAI issues guidelines for students appearing for November 2020 exam and changes in exam schedule for Bihar

The attention of the students who are appearing in November 2020 ICAI examination, in terms of announcement No. 13-CA (EXAM)/N/2020...

Read moreMultipurpose Empanelment form due date extended for 2020-21

Multipurpose empanelment form was made live on 22.09.2020 by ICAI.In simple words this is used for enlisting Chartered Accountant for...

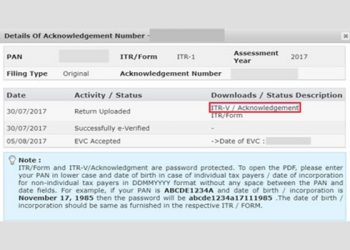

Read moreITR acknowledgement receipt signed and sent to CPC, bangalore but ITR V still not generated? Read this post to find the reason

In our earlier post we had discussed that one cannot generate ITR V until one e-verify ITR or sign and...

Read moreChanges in ITR 6 by virtue of notification 82 of 2020 Dt. 01.10.2020

A few days ago we had discussed that ITR 6 is now available for FY 2019-20 and we had also...

Read moreAmendment in Form 3CD and form 3CEB for FY 2019-20 tax audit w.e.f. 01.10.2020

Form 3CD is a basic Form of Tax audit and needs to be uploaded with all tax audit and audited...

Read moreGSTR 3B can now be filed quarterly, due date for quarterly filing of GSTR 1 changed: 42nd GST council meeting

42nd GST council meeting was held today on 05.10.2020. Key highlights of the meeting are as under: 1. Enhancement in...

Read moreForm 10-IE and 10-IF notified for section 115BAC and 115BAD respectively

It all started with concessional rate of tax for corporates in the form of Section 115BAA and 115BAB for which...

Read moreIncome tax Rules for depreciation under section 115BAA, 115BAB and 115BAC announced

Section 115BAA and 115BAB were announced for lower corporate tax rate also Section 115BAC was announced for lower tax rate...

Read moreNo requirement for scrip wise reporting in case of share trading – Clarification by CBDT

CBDT has vide Press release Dt. 26.09.2020 has clarified that one is not required to report script wise details in...

Read moreE – invoicing under GST has been deferred to 01.11.2020 with some conditions

The Government had in December 2019 prescribed that the GST Taxpayers having aggregate annual turnover more than Rs. 100 crores...

Read moreSFT transaction mentioned in Form 26AS | What does it mean? | Who reports it? | SFT codes transaction type

In past few months we have started seeing various SFT transactions in our Form 26AS. Form 26AS which was earlier...

Read moreFurther clarification on section 206C(1H) – TCS on sale of goods by CBDT through circular

CBDT has issued one circular and one press release in two days to further explain implication of section 206C(1H) which...

Read more