In our earlier post we had discussed that one cannot generate ITR V until one e-verify ITR or sign and sent it to CPC, Bangalore.

We had even talked about how the Form of ITR V has been changed from earlier ITR V.

You can check the comparison here: https://www.taxontips.com/now-you-cannot-generate-itr-acknowledgement-itr-v-until-you-e-verify-your-return-or-send-it-to-cpc-bangalore-new-update-to-itr-v/

Many people have started filing return of income for AY 2020-21 and those are not able to e-verify the same using Aadhar OTP, Bank account EVC or through net banking within 120 days of filing ITR are signing and sending the ITR acknowledgement receipt to CPC Bangalore.

If one doesn’t e-verify or send ITR acknowledgement receipt within 120 days to CPC bangalore the return filed would be considered as defective return u/s 139(9), which would in turn if not replied within 15 days would be considered as you haven’t filed return of income.

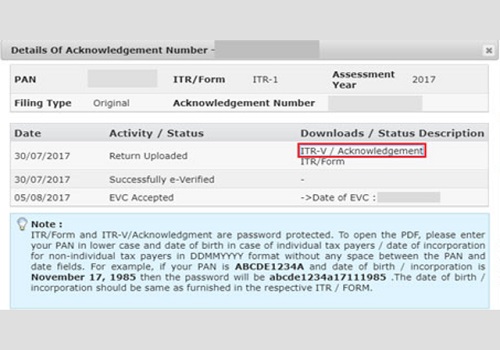

Now, people are filing return and sending the same to CPC bangalore and even after the ITR acknowledgement receipt is received at CPC, people are not able to generate ITR acknowledgement.

Now, they are worried as to why same is not getting converted after it is received at CPC bangalore.

According to our sources in CPC bangalore and from our research we found out that in the new system if one is signing and sending ITR acknowledgement receipt to CPC, same would be converted to ITR V only when the return is processed at CPC.

Therefore if now one is in hurry to submit ITR V for visa or for loan with bank, he/ she should be advised to verify the return with Aadhar OTP, or bank EVC.

Also, from the above methodology of government it can be understood that government is also trying to shift people more towards online verification of ITR rather than physical verification as same is more safe and reliable.

If you need any assistance in filing ITR feel free to book consultation at: https://www.taxontips.com/income-tax-return/

![[Live] Updates and Tax changes for Budget 2023 | Tax on cryptocurrency | Income tax and GST udpates in Budget 2023 [Download Bill]](https://www.taxontips.com/wp-content/uploads/2023/02/Budget-2023-350x250.webp)

![[Live] Updates and Tax changes for Budget 2023 | Tax on cryptocurrency | Income tax and GST udpates in Budget 2023 [Download Bill]](https://www.taxontips.com/wp-content/uploads/2023/02/Budget-2023-120x86.webp)

Do comment your thoughts in the comment and what issues you are facing.

Regards,

Team Taxontips