The concept of a Director Identification Number (DIN) has been introduced for the first time with the insertion of Sections 266A to 266G of Companies (Amendment) Act, 2006. As such, all the existing and intending Directors have to obtain DIN within the prescribed time-frame as notified.

It is an 8-digit unique identification number. Through DIN, details of the directors are maintained in a database.

DIN is specific to a person, which means even if he is a director in two or more companies, he has to obtain only one DIN.

Thus, any person who wishes to be a director in a company in India needs to have a DIN.

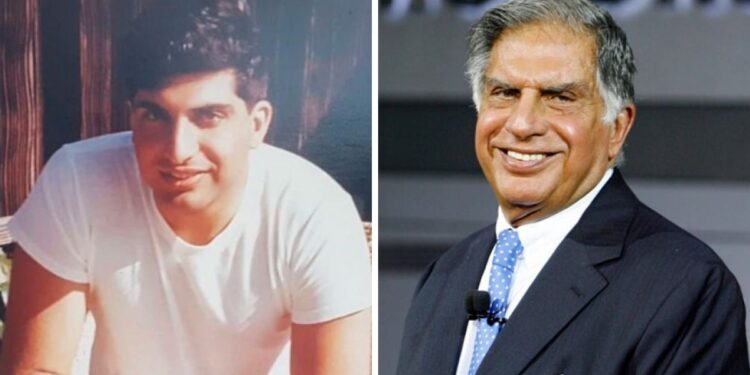

As we know now that concept of DIN was introduced in 2006 and the First DIN which was issued to anyone i.e. DIN No. 00000001 belongs to Mr. Ratan Tata as can be seen in below image:

You can also find this data easily at: http://www.mca.gov.in/mcafoportal/showEnquireDIN.do. It is being said that this No. 1 Director status has been given to him as an honour and he deserves it after all his actions.

At present he is the director in nearly 8 companies.

Director No. 2 i.e. DIN No. 00000002 has also been provided to the director of Tata Group of companies which is as under:

After this no further DIN has been provided, the next DIN number Starts from 00000100. Hence, it can be said that they have been provided this honour of being no. 1 and 2.

After this no further DIN has been provided, the next DIN number Starts from 00000100. Hence, it can be said that they have been provided this honour of being no. 1 and 2.

Procedure to get a DIN number in current scenario is as under:

SPICe Form:

Any person (not having DIN) proposed to become a first director in a new company shall have to make an application through eForm SPICe. The applicant is required to attach the proof of Identity and address along with the application. DIN would be allocated to User only after approval of the form.

DIR-3 Form:

Any person intending to become a director in an existing company shall have to make an application in eForm DIR-3 and should follow the following procedure:

Supporting Documents:

Attach the photograph and scanned copy of supporting documents. i.e. proof of identity, and proof of residence as per the guidelines.

Physical documents are not required to be submitted at DIN cell.

Digital Signature:

Form DIR-3 is mandatory to be signed by the Applicant and shall be verified digitally by a Company Secretary in full time employment of the company or by the Managing Director or Director or CEO or CFO of the existing company in which the applicant is intended to be appointed as a director.

Fee Payment

Upon upload, make the payment of filing fee of eForm DIR-3. Only electronic payment of the fees shall be allowed (i.e. Net banking / Credit Card/Debit Card/Pay later/ NeFT).

The user is required to get himself / herself registered on the MCA21 Portal to obtain Login ID. Login to the MCA21 portal and click on ‘eForm upload’ link available under the ‘eForms’ tab for uploading the eForm DIR- 3.

eForm DIR-3 will be processed only after the DIN application fee is paid.

Generation of DIN

Upon upload and successful payment, in case Form DIR-3 details have not been identified as potential duplicate, Approved DIN shall be generated and if the details have been identified as potential duplicate, Provisional DIN shall be generated.

Verification of e Form:

In case, details of eForm DIR-3 are found as potential duplicate, the same gets routed to DIN cell for back office processing. Upon approval of the form, provisional DIN becomes approved DIN and would be available for further use.

Common Causes of Rejection:

A provisional DIN is approved only after scrutiny of the documents attached with the application.

Some of the common mistakes committed by applicants and on account of which the DIN application gets rejected are as under:

Non-submission of supporting documents

•The proof of identity of the applicant is not submitted.

•The proof of father’s name of the applicant is not submitted.

•The proof of date of birth of the applicant is not submitted.

•The proof of residential address of the applicant is not submitted.

•The copy of passport (for foreign nationals) is not submitted.

Invalid Application/supporting Documents

•The supporting documents are invalid or expired.

•The proof of identity submitted has not been issued by a Government Agency.

•The application/enclosed evidence has handwritten entries.

•The submitted application is a duplicate DIN application and already one application of that applicant is pending or approved.

•The submitted application does not have photograph affixed.

•The signatures are not appended to the prescribed place.

•The applicant’s name filled in application form does not match with the name in the enclosed evidence.

•The applicant’s father’s name filled in application form does not match with the father’s name in the enclosed evidence.

•The applicant’s date (DD/MM/YY) of birth filled in application form does not match with the date of birth in the enclosed evidence.

•The address details filled in the application do not match with those contained in the enclosed supporting evidence.

•The gender is not entered correctly in Form DIR-3.

•Identification number entered in application does not match with the identity proof enclosed.

•If enclosed documents are not self-attested.

DIR-6 Form:

-

If there is any change in the particulars submitted in form DIR-3/SPICe with respect to Directors, applicant can submit e-form DIR-6. For instance, in the event of change of address of a director, he/she is required to intimate this change by submitting e-form DIR-6 along with the required attested document.

Digital Signature:

-

The e-Form DIR-6 is required to be digitally signed by the Applicant and further certified by a Chartered Accountant or a Company Secretary or a Cost Accountant in whole- time practice or company secretary (member of ICSI)/Director of existing company in which applicant is proposed to be the director.

If you wish to read more on same CLICK HERE.

![[Live] Updates and Tax changes for Budget 2023 | Tax on cryptocurrency | Income tax and GST udpates in Budget 2023 [Download Bill]](https://www.taxontips.com/wp-content/uploads/2023/02/Budget-2023-120x86.webp)