In this time of lockdown and when whole country is fighting against Corona virus government started PM cares fund and CM fund to support those who were getting affected by this virus.

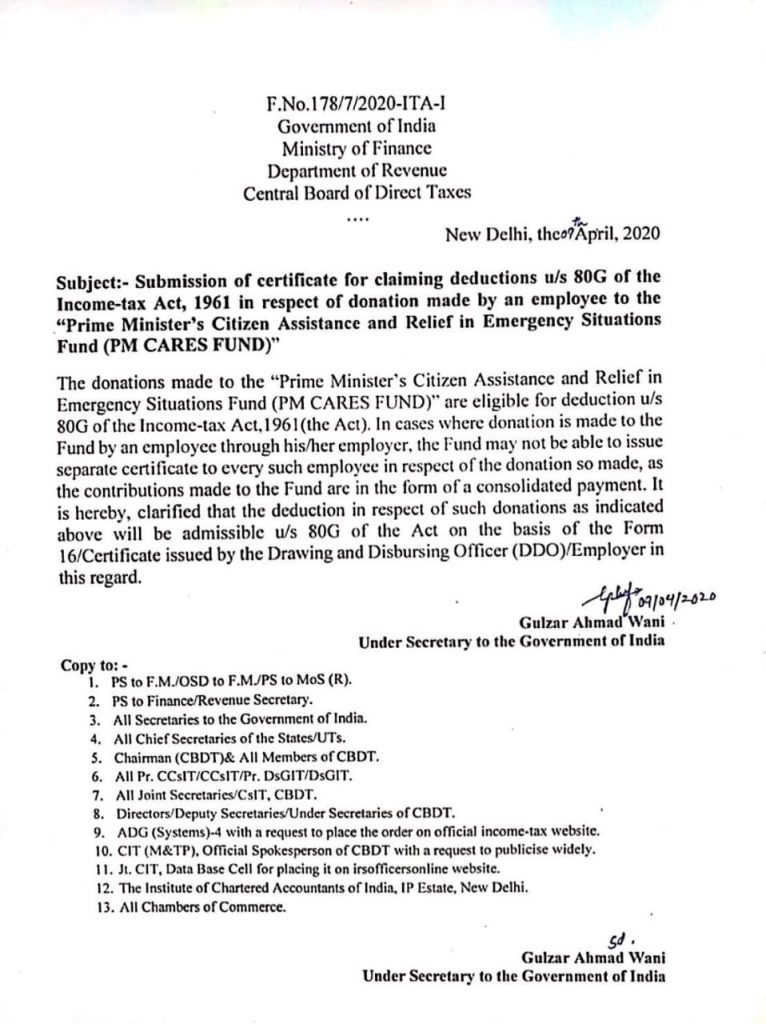

Many employees asked their employer/ organisation to donate their 1 day salary or a month salary to this fund and their organisation or employer would make a lump sum deduction to the PM cares fund. Now the question arise that since the contribution has not been made on individual name of employee how would employee get it’s deduction as the certificate would be issued in name of employer/ organisation and no separate certificate would be issued in name of employee.

In this regard a notification is being circulated which says that employee can claim deduction of such contribution made via his employer on the basis of Form 16/ certificate issued by employer.

However it is worthwhile to mention that no such notification has been till date issued/ posted by Income tax department on its twitter page or official website whereas the date mentioned on the notification is 09.04.2020 and it won’t take 2 days for the department to publish such instruction or notification.

It is therefore advised to wait till the time we receive the notification from some official sources and it can be true but we must wait till the time same is issued on public domain.

This article is just for information purpose it is always advisable to hire a professional for practical execution. If you need assistance you can ask a question to our expert and get the answer within an hour or post a comment about your views on the post and also subscribe to our newsletter for latest weekly updates.

![[Live] Updates and Tax changes for Budget 2023 | Tax on cryptocurrency | Income tax and GST udpates in Budget 2023 [Download Bill]](https://www.taxontips.com/wp-content/uploads/2023/02/Budget-2023-350x250.webp)

![[Live] Updates and Tax changes for Budget 2023 | Tax on cryptocurrency | Income tax and GST udpates in Budget 2023 [Download Bill]](https://www.taxontips.com/wp-content/uploads/2023/02/Budget-2023-120x86.webp)