Dear Member,

In view of impact of Covid-19 across the world and the difficulties faced by Members for completing their mandatory CPE hours’ requirements during the Calendar year 2021, it has been decided by the Competent Authority to extend the last date for complying with the CPE hours’ requirements for the Calendar Year 2021 from 31st December, 2021 to 28th February, 2022. The same may be complied by attending the CPE Programmes in physical/offline mode or in virtual mode through Virtual CPE Meetings/ Digital Learning Hub.

Accordingly following may be noted:

“Requirement of completion of 20 Structured CPE hours which is mandatory to be completed by Members below 60 years holding COP for Calendar Year 2021, can be fulfilled through online mode (either through Digital Learning Hub or through Virtual CPE meetings including mandatory CPE hours on “Code of ethics” and “Standard on auditing”) till 28th February, 2022. To clarify, if a member has earned more than 20 Structured CPE hours through Digital learning Hub and/or VCMs till 28th February, 2022, for compliance purpose, only 20 Structured CPE hours will be credited for Calendar Year 2021.

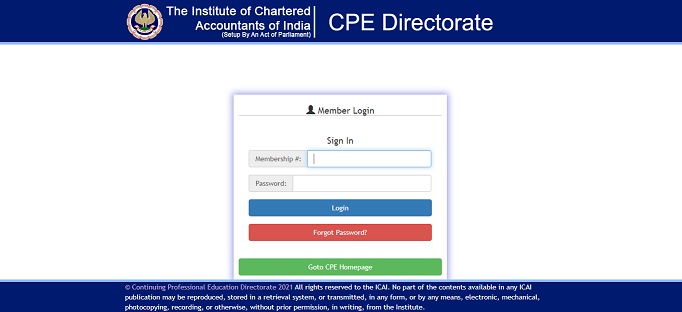

It is pertinent to mention here that the members may acquire contemporary knowledge and skills relevant to their professional duties simultaneously complying with the mandatory Structured CPE hours’ requirements through ICAI’s Digital Learning Hub and Virtual CPE Meetings without paying any fee. The members who have completed their Unstructured Learning Activities (ULAs) but have not updated its details on the CPE Portal for Calendar year 2021 are requested to kindly claim the CPE Hours credit of unstructured learning online by login into your account on CPE portal www.cpeicai.org

It may be noted here this is the last opportunity for members to complete their respective CPE hours’ requirements for the Calendar year 2021, till 28th February, 2022 as no further extension will be granted.

Happy Learning!!

With kind regards

To read more CLICK HERE.

You can book phone consultation/ assistance online with expert as mentioned below:

To book ITR filing with experts CLICK ME.

To book phone consultation with experts for any Income tax related matters CLICK ME.

To book consultation for Faceless Assessment with experts CLICK ME.

To book phone consultation with experts for GST related matters CLICK ME.

To book general phone consultation with expert CLICK ME.