Section 206C(1H) – TCS on sale of goods was introduced in Income tax act by Finance Act, 2020 wherein it was mentioned that seller of the goods whose turnover in previous year is above Rs. 10 crore will have to collect TCS on receipt of payment above Rs. 50 lakh from one buyer.

The above section was made effective from 01.10.2020.

However, now a new issue has arisen in this saga. October 2020 was the first month of this provision and the due date for payment of TCS collected in the month is 07.11.2020.

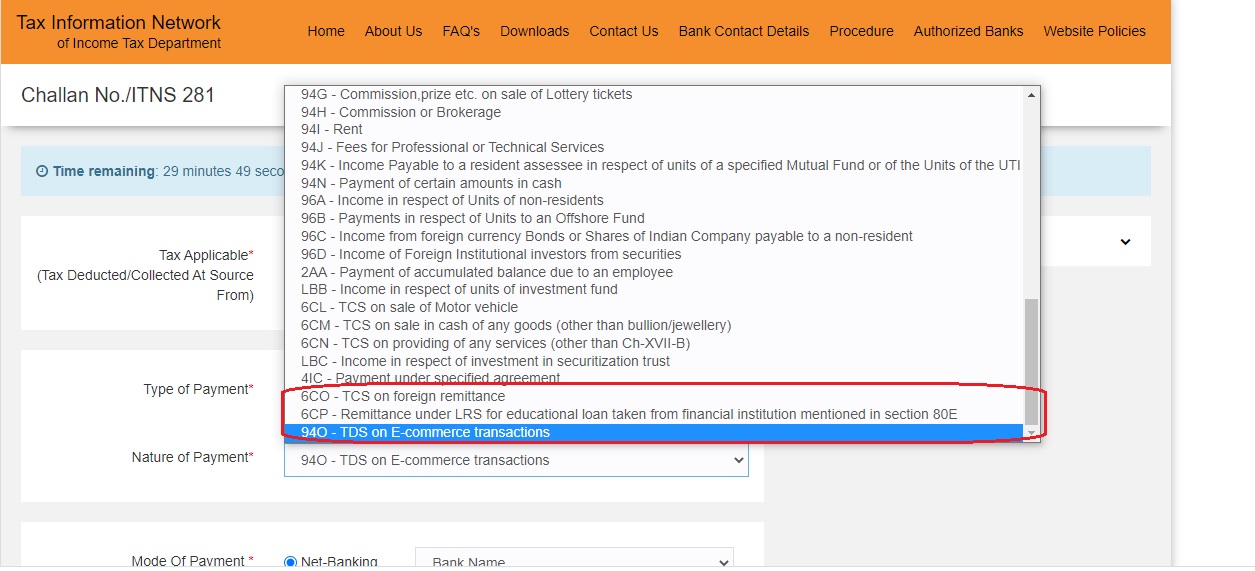

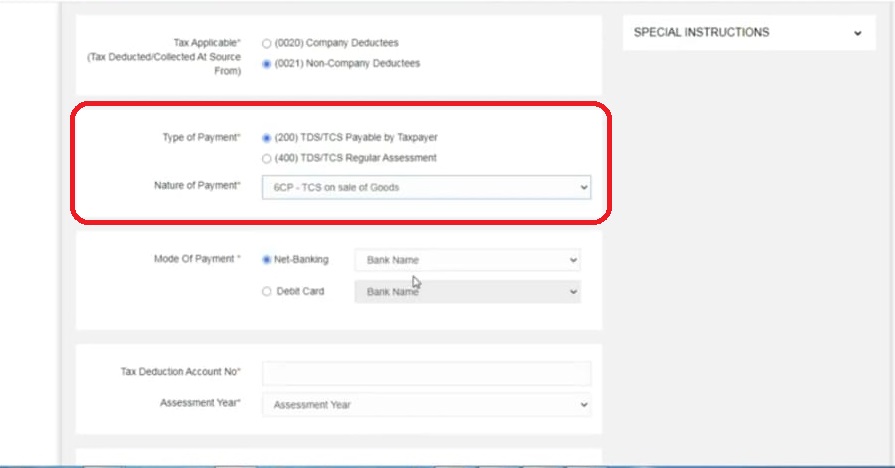

As of now no challan is available to make payment of TCS collected on sale of goods. If you visit Tin-NSDL website which is used to make tax payment you won’t find an option to deposit TCS collected on sale of goods under nature of payment.

Screenshot for the same is as under:

From the above it can be seen that all other TCS/ TDS provision which were added from 01.10.2020 have been made available above like remittance under LRS scheme, foreign remittance etc but TCS for sale of goods is not available.

From the above it can be seen that all other TCS/ TDS provision which were added from 01.10.2020 have been made available above like remittance under LRS scheme, foreign remittance etc but TCS for sale of goods is not available.

Although TCS for tour operator is also not specifically available but same can be added in TCS on providing any service but this is not even service and hence there is no relevant nature of payment available for this.

A message is being circulated where it is being said that the above option has been added and department is aware of same and it shall be made live soon. The message being circulated is as under:

“Respected users

Department today changed its portal for challan payment of “TCS ON SALE OF GOODS”

As per direction of TRACES please wait for challan payments under this head.

We will revert you when option for payment available on portal.

Thanks“

Till yesterday the website Tin NSDL was showing option to pay TCS on sale of goods at 6CP code but now the same option shows 6CP as Remittance under LRS for education loan taken from financial institution mentioned in section 80E.

It will be interesting to see that if the option is not available till tomorrow will the tax payers bear interest on late payment or will government waive such interest or the tax payer should use some other challan to make the payment and later on settle it against this?

These are the few questions which needs to be answered and you can comment your thought as well on same.

![[Live] Updates and Tax changes for Budget 2023 | Tax on cryptocurrency | Income tax and GST udpates in Budget 2023 [Download Bill]](https://www.taxontips.com/wp-content/uploads/2023/02/Budget-2023-350x250.webp)

![[Live] Updates and Tax changes for Budget 2023 | Tax on cryptocurrency | Income tax and GST udpates in Budget 2023 [Download Bill]](https://www.taxontips.com/wp-content/uploads/2023/02/Budget-2023-120x86.webp)

SBI bank is not accepting challan

Check now sir, people have commented they are accepting now. Please check our latest post for same: https://www.taxontips.com/not-able-to-make-payment-of-tcs-on-sale-of-goods-u-s-206c1h-bank-shows-invalid-payment/

From ICICI bank TCS on sale of goods are accepting.

while making payment under sec CR-TCS on sale of goods we are facing problem. After filling all data in form 281 at the time of making payment “Invalid nature of payment” message is showing and it is not going to bank site. What to do? please reply.

Please check now sir people have said it is now accepting Please check our latest post for same: https://www.taxontips.com/not-able-to-make-payment-of-tcs-on-sale-of-goods-u-s-206c1h-bank-shows-invalid-payment/

while making payment under sec CR-TCS on sale of goods we are facing problem. After filling all data in form 281 at the time of making payment “Invalid nature of payment” message is showing and it is not going to bank site. What to do? please reply.

Please check now sir people have said it is now accepting Please check our latest post for same: https://www.taxontips.com/not-able-to-make-payment-of-tcs-on-sale-of-goods-u-s-206c1h-bank-shows-invalid-payment/

already paid tcs under code 6CP, now what to do? it shows TCS on sale of goods on challan.

You will have to use and consume the same challan no other option available as you had paid for the correct purpose.

Regards,

Team Taxontips.com

I have face same problem

We shall post an update on same by tomorrow.

Stay connected and subscribed to know more.

Regards,

Team taxontips.com

6CM Description is also wrong. Please update the same.

Good evening sir,

Can you please elaborate as to how the same is wrong?

Regards,

Team Taxontips.com