In our earlier post we had discussed that many people are receiving compliance notice for FY 2019-20 after they have filed Income tax return and after the due date for filing revise return is also over i.e. after 31.03.2021.

Majority of that notices were related to not showing interest income in Income tax return and people did not know what to do with this information after due date for filing return was over.

However, later people also started receiving compliance notices stating that there are high value transaction which have not been reported in the Income tax return. The message read as under:

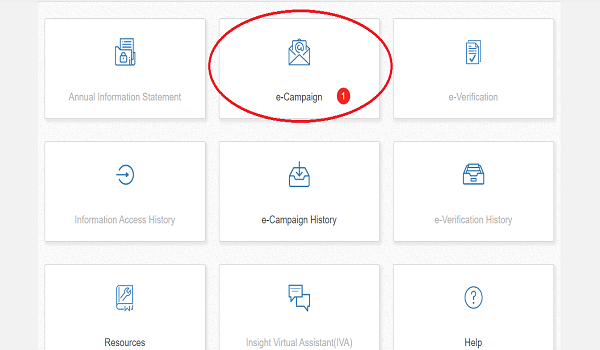

“Attention _________________ (XXXXX2849X),The Income Tax Department has identified high value information which does not appear to be in line with the Income Tax Return filed for Assessment Year 2020-21 (relating to FY 2019-20). Please revise ITR / submit online response under e-Campaign tab on Compliance Portal (CP). Access CP by logging into e-filing portal and clicking on ‘Compliance Portal’ link under ‘My Account’ or ‘Compliance’ tab – ITD”

All this notices were received after the due date to file revised return was also over and when one used to check this transaction on compliance portal those were related to GST turnover and in the message it would be mentioned that assessee has not shown such transaction in it’s income tax return.

After receiving such message assessee get’s mad at his Tax consultant. However, when tax consultant used to check these transactions, they were properly shown in his income tax return along with disclosing GST turnover as per GST return.

Hence, assessee was again confused as to how to show or reply to such compliance notices because there were only three options that either information was correct or incorrect or partly correct and in the compliance portal it was nowhere mentioned that these details were missing in Income tax return, it was only in the text message mentioned above that such thing was mentioned.

There was a lot of confusion between assessee and tax practitioner and after a few days when consultant went to reply such notices on the portal the notice was not available and it had vanished.

The reason behind such action might be that Income tax department must have understood their mistake that they were not checking things correctly and hence they have taken back many such notices.

If you have also received any such notice do check it’s status.

Takeaways:

In the past also Income tax department has created such issues wherein they issue notices in bulk to the taxpayers for mismatch and then take it back. For eg: In case of trust or late fees.

Such notices just create a tension between a client and his tax consultant because the client thinks that tax consultant is not doing proper work and this can lead to a tax consultant loosing his client because all that a client is not receiving any notice from Income tax department.

When the client receives such notice he does not understand whether it is correct or not he just doubts efficiency of his tax consultant.

Hence, before sending any such notices the department should check it’s mechanism first.

Further, it is not appropriate to compare the turnover as per GST and turnover as per Income tax because definition of turnover in both the law is different. Hence, department should think about the mechanism the checks and then send out notices to assessee.

![[Live] Updates and Tax changes for Budget 2023 | Tax on cryptocurrency | Income tax and GST udpates in Budget 2023 [Download Bill]](https://www.taxontips.com/wp-content/uploads/2023/02/Budget-2023-350x250.webp)

![[Live] Updates and Tax changes for Budget 2023 | Tax on cryptocurrency | Income tax and GST udpates in Budget 2023 [Download Bill]](https://www.taxontips.com/wp-content/uploads/2023/02/Budget-2023-120x86.webp)