Our Hon’ble Finance Minister Smt. Nirmala Sitharaman had held a Press conference on 12.11.2020 to announce various schemes under Atma Nirbhar Bharat 3.0, which included a relief for home buyers and developers.

As we know the reality sector was facing a depression with people buying less homes and developers having inventory.

Recently even the interest rates on Home loans were reduced significantly by RBI as well to boost economy and motivate people to buy homes.

Now, Our hon’ble Finance minister has announced a scheme under Atma nirbhar bharat which is supposed to boost the demand for homes.

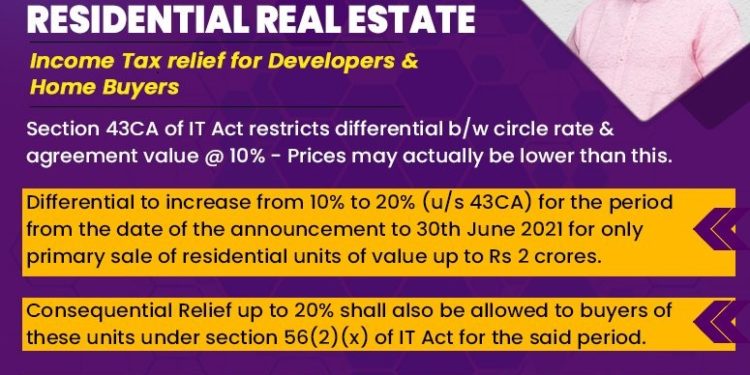

The scheme provides relief under Income tax act and various relief and conditions linked to same are as under:

1. Amendment to section 43CA of Income tax act to increase the limit of differential amount between circle rate/ DLC rate and actual sale consideration to 20% from existing rate of 10% for developers.

2. Similar amendment to section 56(2)(x) for home buyers.

3. The amendment shall be made effective from date of announcement i.e. 12.11.2020 to 30.06.2021.

4. The benefit is available for primary sale of residential house upto Rs. 2 crore.

The relevant amendments in Income tax Act shall be made soon.

Let’s understand what this amendment means:

There is a circle rate of any property which is decided by the local property and if a person wishes to buy a property below that a margin of 10% was allowed, if a person would sell below 10% then in that the seller would have to declare that circle rate as sale consideration and pay tax on same.

Also in such case the buyer would also pay tax on difference amount u/s 56. Thus, it was not a great situation for both buyers and seller.

Also, this section used to cause a bit of hinderance when real estate market is facing a depression and people were not ready to purchase property on circle rate and developers were ready to sell the property at lower rate to reduce their stock.

Thus, now with the increase in such rate it shall give a boost to home buyers when we combine this with lower housing loan rate.

Let’s understand what does point no. 4 in above conditions means that it shall be applicable to primary sale.

Amendment has been made to section 43CA of the Income tax act which is applicable to people who does not hold land or building as capital asset i.e. developer the rate has been increased for them.

Thus, if a normal seller, sells his house or land who holds such property as capital asset, to them section 50C shall be applicable where the eligible rate of difference is still 10% between circle rate and sale consideration.

Thus, if a normal seller of property or a person sells his property in secondary market/ resells the property then in that case such relaxation shall not apply.

Although some might think that this is not a major relief in itself but it will definitely add to the benefits and add to the bigger picture.

Comments 2