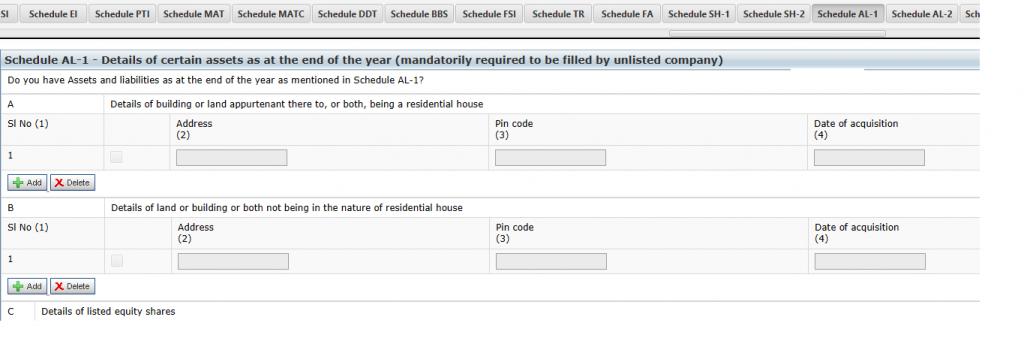

The due date for filing return of income is 30th September and CBDT has released new schema for companies in ITR 6 today i.e. 26.09.2019 without any circular to mention the changes made to ITR. Earlier it was speculated that Schedule SH and AL which were newly introduced would be modified but looking at the new ITR 6 at first there is only one visible change in the Form i.e. For Schedule AL -1 they have provided an option to assessee to choose whether AL – 1 is applicable or not by asking a question “Do you have Assets and liabilities as at the end of the year as mentioned in Schedule AL-1“. This will make AL -1 optional for companies who do not have any such asset i.e. companies who hold asset just for investment purpose as in the drop down there is no option to choose an asset just for investment purpose and also for those companies which have been closed. Let’s see if any change is notified by government or not and after this change we can assume that due date to file tax audit report would certainly increase.

If you need assistance you can ask a question to our expert and get the answer within an hour or post a comment about your views on the post.

![[Live] Updates and Tax changes for Budget 2023 | Tax on cryptocurrency | Income tax and GST udpates in Budget 2023 [Download Bill]](https://www.taxontips.com/wp-content/uploads/2023/02/Budget-2023-350x250.webp)

![[Live] Updates and Tax changes for Budget 2023 | Tax on cryptocurrency | Income tax and GST udpates in Budget 2023 [Download Bill]](https://www.taxontips.com/wp-content/uploads/2023/02/Budget-2023-120x86.webp)