As we know a relief was announced by our Hon’ble FM on 13.05.2020 wherein various direct tax relief was also announced one of which was reduction in TDS rate by 25%. This reduction would apply to all TDS rate other than TDS on salary.

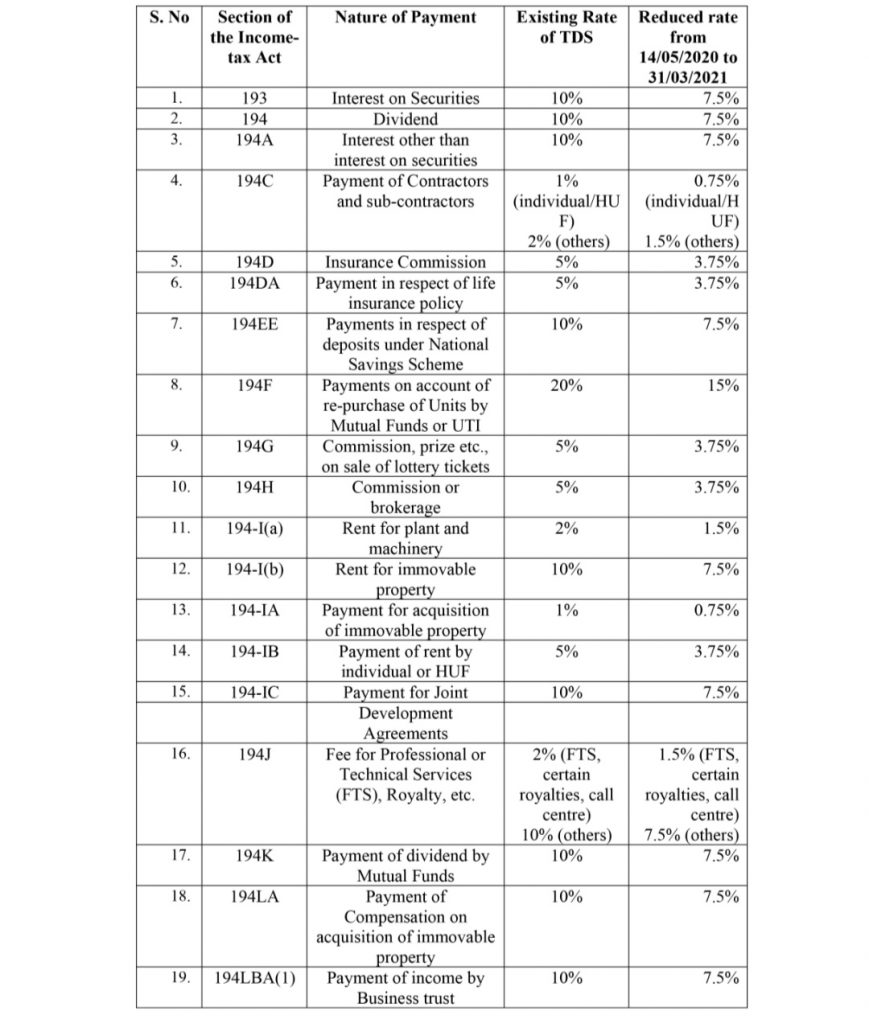

Noteworthy – no reduction in 2% TDS rate u/s 194N for Cash withdrawal greater 1cr and if withdrawer has not filed return in last 3yrs, than 2% TDS for cash withdrawal greater than 20 lakhs and 5% TDS for greater than 1cr. Now, below is the chart showing new TDS rates:

TCS rates are as below:

There has been a small typographical error in the table pertaining to reduction in TDS/TCS rates in the Press Release issued on 13/05/2020. The new rate of TCS in column no. 4 w.r.t. sale of any other goods u/s 206C (1H), should be read as 0.075% instead of 0.75%.

It is further stated that there shall be no reduction in rates of TDS or TCS, where the tax is required to be deducted or collected at higher rate due to non-furnishing of PAN/Aadhaar. For example, if the tax is required to be deducted at 20% under section 206AA of the Income-tax Act due to non-furnishing of PAN/Aadhaar, it shall be deducted at the rate of 20% and not at the rate of 15%.

To read full Press release CLICK HERE.

To read TDS/ TCS related press release CLICK HERE.

This article is just for information purpose and are personal views of the author. It is always advisable to hire a professional for practical execution. If you need assistance you can ask a question to our expert and get the answer within an hour or post a comment about your views on the post and also subscribe to our newsletter for latest weekly updates.

![[Live] Updates and Tax changes for Budget 2023 | Tax on cryptocurrency | Income tax and GST udpates in Budget 2023 [Download Bill]](https://www.taxontips.com/wp-content/uploads/2023/02/Budget-2023-350x250.webp)

![[Live] Updates and Tax changes for Budget 2023 | Tax on cryptocurrency | Income tax and GST udpates in Budget 2023 [Download Bill]](https://www.taxontips.com/wp-content/uploads/2023/02/Budget-2023-120x86.webp)

Comments 2