Earlier launched by CBIC via notification no. 31/2019 CT on 28th June 2019, PMT 09 is the prescribed challan for relocating the falsely or erroneously paid ITC. For example, if you have paid CGST instead of SGST, you can rectify it by using this challan which is known as GST PMT 09.

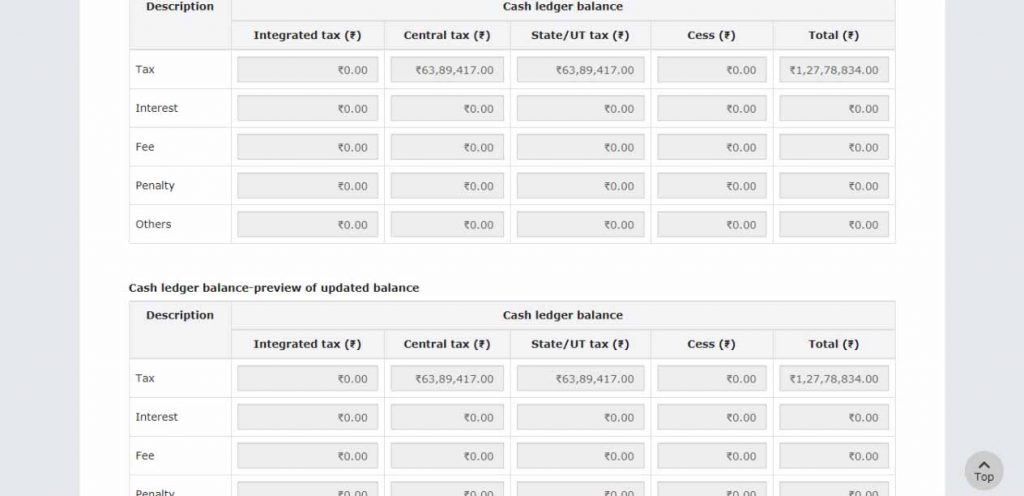

However it will not live till today. Now one could use PMT 09 to make changes in different head of challan if one has paid challan in cash and now there is no requirement for rectifying the challan even if wrong details have been mentioned. Hence, you can only PMT-09 to change head of the amount available in cash ledger and not the one available on credit ledger.

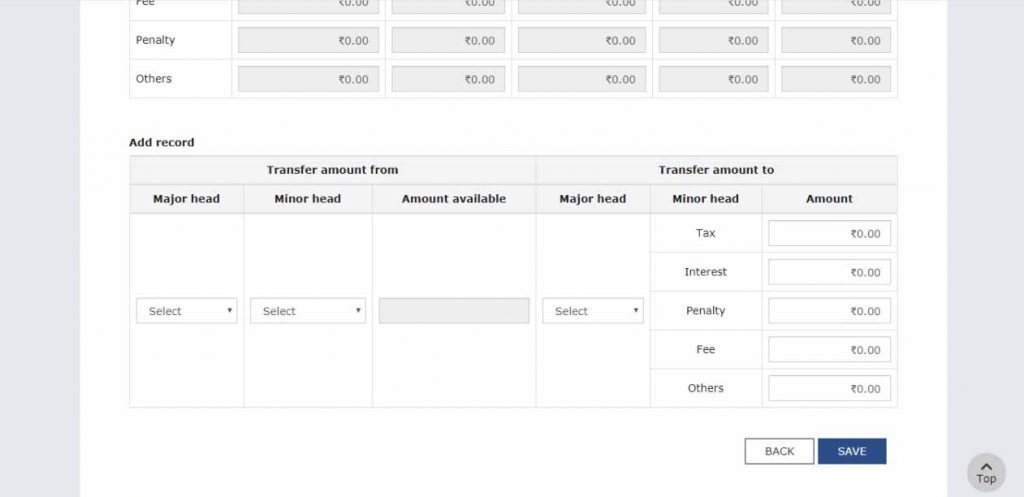

Now, taxpayer can transfer the cash balance available under one head to another head of tax i.e. from CGST/ IGST to SGST or interest or penalty or vice versa. In order to that, the taxpayer will have to login first then go to Services –>Ledgers–>Electronic Cash Ledger—> File GST PMT-09 For Transfer of Amount.

This article is just for information purpose it is always advisable to hire a professional for practical execution. If you need assistance you can ask a question to our expert and get the answer within an hour or post a comment about your views on the post and also subscribe to our newsletter for latest weekly updates.

![[Live] Updates and Tax changes for Budget 2023 | Tax on cryptocurrency | Income tax and GST udpates in Budget 2023 [Download Bill]](https://www.taxontips.com/wp-content/uploads/2023/02/Budget-2023-120x86.webp)