As we all know Income tax department is going paperless, linking all our accounts and tracking all our financial activities and as part of same it has not started sending notices to assessee’s reminding them to file their return of income for F.Y. 2018-19, if they haven’t filed the same and if they have entered into high volume transactions or even sending same kind of notices for advance.

Assessee’s are receiving messages such as: “Attention (DJCPXXXX0X), Your PAN has been flagged for not filing of ITR for FY 2018-19. Please file your ITR or submit online response under e-Campaign tab on Compliance Portal (CP). Access CP by logging into e-filing portal (My Account) – ITD”

Now the above messages doesn’t provide any details it just says that your PAN has been flagged. Hence, to check what transactions have been tracked by Income tax department assessee needs to log in to his e filing website account.

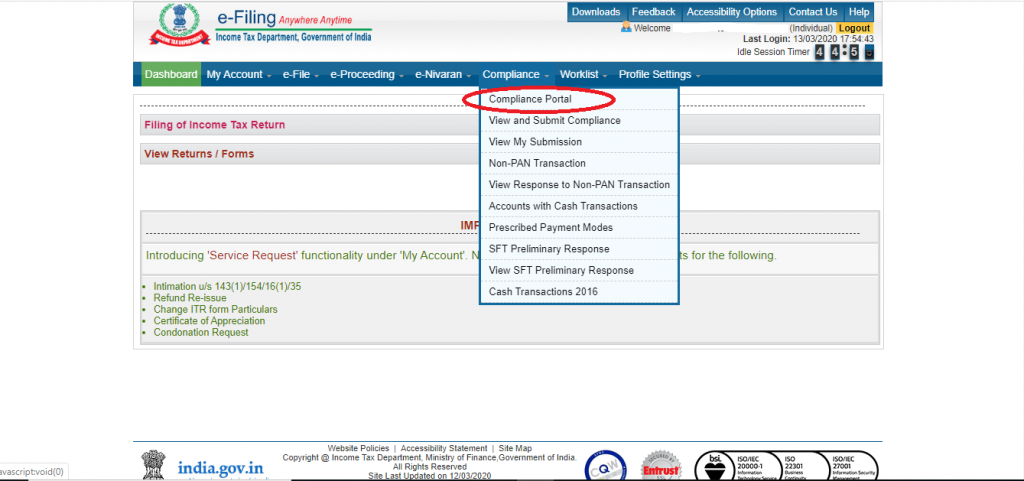

After logging in you need to click on compliance tab and then on compliance portal.

Then you need to click on Continue and you would be redirected to a new portal which will a compliance portal.

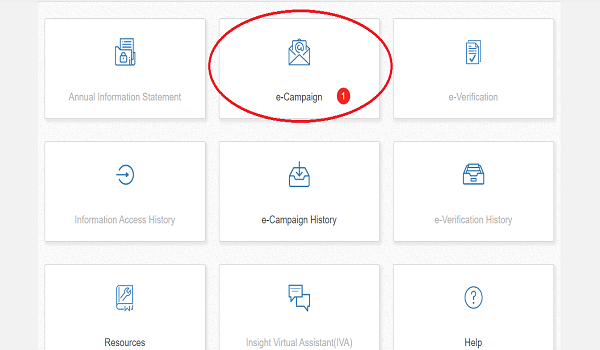

As you click on confirm you will be redirected to Compliance portal which was earlier prepared by Income tax department for collecting AIR information and now same is used for compliance purposes and sending notices to assessee regarding their transactions. Here you need to click on E-campaign.

Next you would be provided three options:

First one is being used for people to whom advance tax payment notices is being sent.

Second is used for people who have significant transaction but have not filed their return of income.

Third is for people in whose ITR there are some mismatch in information.

Currently we are seeing people receiving information for first and second type.

You will see the message below the tab for which you have received notice as highlighted below.

Next you need to click on it.

In both cases as soon as you go inside you’ll find the details of transaction.

In this example as we click on second type of e-compliance you will again see two tabs one showing response on filing of Income tax return and Information confirmation.

In the first tab you need to write your response on whether you were required to file return or not and if you have filed your return then you need to provide its acknowledgement number if you haven’t filed it then you need to provide the reason for not filing.

In the next tab you need to tick each transaction and say whether you agree with that transaction or you don’t agree with that transaction. It is same as how GST returns work where you need to accept credit or reject the credit.

If you know your total income was below maximum amount not chargeable to tax then you might write that you are not liable to file return of income and file compliance.

Many people have done thousands of share transaction and they don’t know how to tick each and every transaction as it would be quite cumbersome and currently its the first time Income tax department is sending any such notices and no penalty has been mentioned if one doesn’t comply to such notices.

However it is advised to comply with such notices and tick the transactions properly to avoid any income tax assessment notice.

To book a consultation with our experts CLICK HERE.

This article is just for information purpose it is always advisable to hire a professional for practical execution. If you need assistance you can ask a question to our expert and get the answer within an hour or post a comment about your views on the post and also subscribe to our newsletter for latest weekly updates.

![[Live] Updates and Tax changes for Budget 2023 | Tax on cryptocurrency | Income tax and GST udpates in Budget 2023 [Download Bill]](https://www.taxontips.com/wp-content/uploads/2023/02/Budget-2023-350x250.webp)

![[Live] Updates and Tax changes for Budget 2023 | Tax on cryptocurrency | Income tax and GST udpates in Budget 2023 [Download Bill]](https://www.taxontips.com/wp-content/uploads/2023/02/Budget-2023-120x86.webp)

Dear Sir /Madam,

Very nicely explained with graphics. Thank you.

I too received a message to file the ITR as I purchased a property in 2019 but since I am an NRI and I don’t have any income in India, as I understand I need to do 2 things on the “e campaign compliance portal “. Once I am in e campaign I have to submit 2 things separately

1) On “response to filing on ITR” I need to select “not liable to taxable income” however in the field down below I want to write comments, could you tell me what should be written that is self explanatory. (can you help me phrase the text before clicking submit.”

2) secondly on the right side I have “Information confirmation” under which I guess I need to select the first option that says that “all information mentioned is correct” and then submit.

Many thanks for your help,

regards

Babu

I would suggest you to take a phone consultation with our experts so that they can first check what notice you have received and then provide you a suitable response.

You can book the phone consultation Here: https://www.taxontips.com/income-tax-return/

Regards,

Team Taxontips.com

Can we write a E mail stating that as there is large information requring confirmation of related information summary and considering current lockdown situation grant us some more time to provide online response? if yes what is mail address to which communication to be send.

No currently there is no such email nor there is any time limit so you can file your reply there itself and later or amend your reply to such compliance notice.

Regards,

Team Taxontips.com