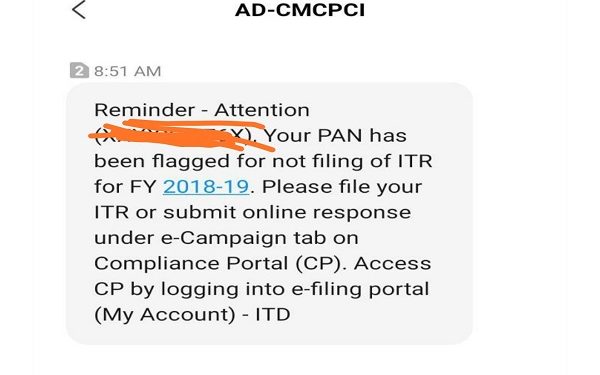

As we know 30.09.2020 is the last date to file return of income for FY 2018-19 and therefore Income Tax department is running a campaign where they send message and e-mail to people those who have done a few high value transaction but have not filed their return of income.

We had discussed about the compliance portal in our earlier post. We had even talked about the campaign of income tax department wherein it will send notices to non filers. However, now since the due date for filing return of income has been extended so is the campaign.

Basically the campaign is to aware people who have not filed Income tax return or who are not aware whether they are required to file ITR or those who are not aware about such transaction and hence to reduce future litigation.

Thus, the people who receive any such SMS or e-mail from Income tax department should not panic but just check first the compliance portal and for the reason for non-filing and the transaction listed and answer the queries.

If you are not aware as to how to check the query or how to reply, you can always book a consultation with our experts who will guide you.

Now, based on the responses/ queries received by us from people, we came to know that most of the people who have received such SMS are people who have done transactions in share market/ stock exchange and have not filed their return of income thinking that they are not required to file return as their income is below 2.5 lakh or they have made a loss.

The interpretation of people is correct that they are not required to file return. As far as Income tax department is concerned they have both the figures i.e. figure of sale of shares as well as purchase of shares. However, to collect taxes they only see sale of shares and ask assessee to explain or prove that he/ she has incurred a loss.

If the assessee would have filed the return at due date, this would have helped him in two ways:

1. He/ she wouldn’t have received such notice.

2. He/ she could have carried forward the loss.

Now, if the assessee files the return he cannot carry forward the loss as loss cannot be carried forward if return filed after due date u/s 139(1).

Another option available is to just write a reply against such notice of non filing of return.

However, it is still advisable to file the return within due time as the loss can be carried forward till 8 years in normal situation and used to save tax in future by setting it off against future profit.

If you need any assistance in filing the return of income you can book a slot with our expert by CLICKING HERE.

![[Live] Updates and Tax changes for Budget 2023 | Tax on cryptocurrency | Income tax and GST udpates in Budget 2023 [Download Bill]](https://www.taxontips.com/wp-content/uploads/2023/02/Budget-2023-350x250.webp)

![[Live] Updates and Tax changes for Budget 2023 | Tax on cryptocurrency | Income tax and GST udpates in Budget 2023 [Download Bill]](https://www.taxontips.com/wp-content/uploads/2023/02/Budget-2023-120x86.webp)