Important Terminologies in relation to HUF

- 1) Hindu

The Constitution of India has defined the term “Hindu”. The term “Hindu” has been defined in the Constitution under Explanation II of Article 25(2)(b) as “Hindus shall be construed as including a reference to persons professing the Sikh, Jaina or Buddhist religion, and the reference to Hindu religious institutions shall be construed accordingly”.

The following persons are Hindus, Buddhists, Jainas or Sikhs by religion, as the case may be:

Any child, legitimate or illegitimate, both of whose parents are Hindus, Buddhists, Jainas or Sikhs by religion;

any child, legitimate or illegitimate, one of whose parents is a Hindu, Buddhist, Jaina or Sikh by religion and who is brought up as a member of the tribe, community, group or family to which such parent belongs or belonged; and

Any person who convert or re-convert to the Hindu, Buddhist, Jaina or Sikh religion.

- 2) Family

Family connotes a group of people related by blood or marriage.

- 3) Hindu Undivided Family (HUF)

HUF is a family which consists of all persons lineally descended from a common ancestor and includes their wives.

- 4) Karta

Karta is head of the Hindu Undivided Family. He is also called manager.

- 5) Coparcener

Coparceners consist of male ancestors and his lineal descendants in the male line within four degrees including him.

Further, a daughter of coparcener shall also by birth become coparceners in the same manner as son.

- 6) Member

All the persons of family including coparceners are called as member of HUF.

However, it is important to note that all coparceners are members but all members are not coparcener.

Note: Above terminologies has been described in short to get an idea about same. The detailed analysis of terms will be made as and when need for its application arise.

A HUF cannot be created under a contract, it is created AUTOMATICALLY in a Hindu Family. This happens by marriage, birth or adoption. Let’s understand the same:

HUF cannot be constituted by the acts of parties. Thus, two brothers cannot join together to say that they have constituted a HUF.

As seen above, HUF cannot be created. Hence, when one talks of creating a HUF, one implies creating such an entity for tax purpose.

A Hindu Undivided Family for tax purposes can only come into existence if it owns some property or earns some income which is taxable.

However, it is important to note that for an entity to be taxed as a HUF, it should have at least TWO coparceners.

There are various ways through which HUF can become taxable entity, few are mentioned as under:

- Through receipt of gifts

- By blending of individual property with the character of HUF property

- By inheritance under a will

- When there is partition in a larger HUF

- Through Joint labour for the benefit of HUF

It is not mandatory to have a deed for the formation of an HUF. However, it is advisable to execute one from a legal and taxation perspective.

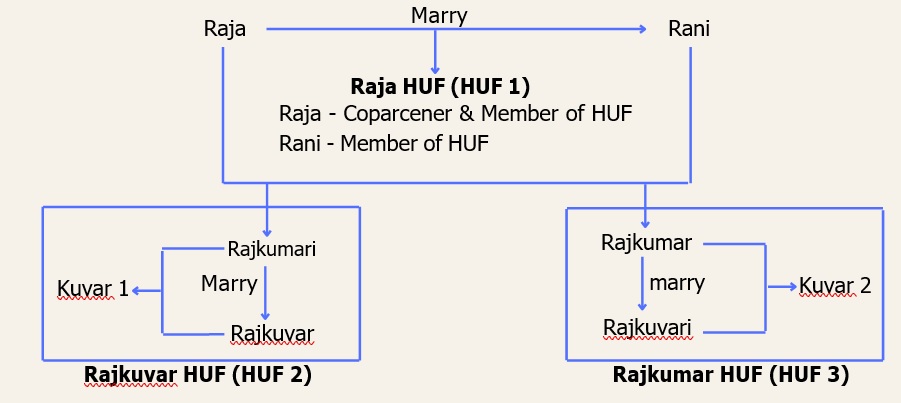

Membership in Multiple HUFs

It is possible that an individual can be a member of more than one HUF at the same time.

To understand the same in simple manner, consider below example.

Now, Consider the below table:

| Name | Raja HUF (HUF 1) | Rajkuvar HUF

(HUF 2) |

Rajkumar HUF

(HUF 3) |

| Raja | Coparcener & Member | ***** | ***** |

| Rani | Member | ***** | ***** |

| Rajkumari | Coparcener & Member | Member | ***** |

| Rajkumar | Coparcener & Member | ***** | Coparcener & Member |

| Rajkuvar | ***** | Coparcener & Member | ***** |

| Rajkuvari | Member | ***** | Member |

| Kuvar 1 | ***** | Coparcener & Member | ***** |

| Kuvar 2 | Coparcener & Member | ***** | Coparcener & Member |

It can be seen from the above table, an individual can be a member in more than one HUF concurrently.

HUF : Special Aspects

There must be more than one person in the family before a HUF come into existence.

If a Hindu man marries a Christian lady under Special Marriage Act, then son born to them if brought up as a Hindu would be a Hindu, and such a son can validly form a HUF with his father.

In another situation where Hindu man marry a Christian lady and their son is brought up as a Christian, then the man, his wife and son would not constitute a HUF.

In a situation where a Hindu family is reduced to a single male coparcener without any female member, such a family (Consisting of single individual) has to be treated as an individual and not as a HUF. There can be a HUF all of whose members are coparceners. However, there cannot be a HUF without a coparcener.

There can be a HUF consisting of female members only. There also can be a HUF consisting of male members only.

HUF can consist of a single male member, his wife and unmarried daughters.

HUF can consist of one male member and his unmarried daughter.

A surviving male member of HUF, unmarried or widower cannot form a HUF.

As per the Hindu Adoptions and Maintenance Act, 1956, an unmarried female can adopt a child. However, that adoption can not give a birth to HUF. On contrary, a widow also can adopt a child as per the said act. In that case, the adopted child becomes the child of the deceased husband also and such adoption can brings into existence a HUF.

Karta, Coparcener, Member

Karta

As we know, karta is head of the Hindu Undivided Family. He is also called manager.

The primary qualification to become a karta of a HUF is that the person must be a coparcener of the family.

In general, the senior most member of the family is the of Karta of HUF. So in general, father is the karta of the HUF.

A question may arise that can a mother become Karta in a situation where father of the family is no more. As we have seen, the primary qualification for karta is coparcenership. We have also seen earlier that mother does not have coparcenership in the family. Resultantly, a mother cannot be a karta of the HUF of her husband.

However, it is important to note that a daughter can become a karta as she has coparcenership in his father’s HUF.

A Karta has absolute power to manage the property belonging to HUF. Any coparcener, who is not satisfied with the decisions of Karta, can demand partition of HUF property at any point of time.

Further, a son can be a member of his father’s HUF and can have his own HUF also. Further, if he is the eldest son in case of death of his father he shall become karta of both HUF.

Coparcener

Coparcener consists of male ancestors and his lineal descendants in the male line within four degrees including him.

Further, a daughter of coparcener shall also by birth become coparceners in the same manner as son.

Coparceners are superior over Non coparcener members.

Only the Coparceners have the right to demand the partition of HUF.

Member

The persons of family including coparceners are called as member of HUF.

It is important to note that all coparceners are members but all members are not coparcener.

There can be a HUF where all members are coparceners of HUF.

A member of HUF does not have any right for asking partition of HUF.

Obtaining a PAN for HUF

As a taxable entity, PAN is the primary requirement.

For obtaining a PAN, along with application of PAN, a HUF deed or affidavit about HUF is required to be enclosed.

Once the PAN has been allotted, based on it bank account can be opened and other legal transactions can be undertaken by HUF.

Residential Status

A HUF is said to be resident in India in any previous year in every case, except where during that year the control and management of its affairs is situated wholly outside India.

If the control and management of the affairs of the HUF is wholly located outside India than it will be treated as non-resident.

A HUF is said to be “not ordinarily resident” in India in any previous year if its Karta has been a non-resident in India in 9 out of the 10 previous years preceding that year, or has during the 7 previous years preceding that year been in India for a period of, or periods amounting in all to, 729 days or less.

In all other cases the HUF is “resident and ordinarily resident”.

In a situation where Karta of HUF resides outside India and HUF is managed by the other members residing in India, then also the HUF will be treated as Resident in India.

Based on the residential status of the HUF, the income of the HUF is liable to tax.

Formation of HUF Properties

As the HUF is come into existence automatically, it can exist even without ancestral joint property.

Following are the various ways through which HUF property can be created:

- Receipt of gifts

- Blending of individual property with the family property

- Inheritance through a will

- Partition of a larger Hindu Undivided family

- Devolution of interest in coparcenary property of a coparcener who dies intestate

- Reunion of separated coparceners

- Doing joint labour for the benefit of HUF

From above all method, method of gift and will is the widely used ways for creating a HUF property.

If a gift is made with the clear and unambiguous declaration that it is being made for the benefit of the Hindu Undivided Family of donee as different from the donee individually, such gifted property would bear the character of HUF property. However, the clubbing provisions need to be keep in mind while making the gift.

From the capital created by the HUF, it can earn further income and generate more capital. The HUF can earn income from all sources except Salary and the income so earned would help the HUF create more capital.

There is no restriction on HUF in holding any kind of movable and immovable assets.

It is important to note that any account opened in the name of HUF cannot be opened with joint holders. Further, no nominee can be appointed for the HUF accounts.

HUF & Gift

Gift to HUF by its Members

As we know gift is the widely used method for creating HUF as taxable entity.

Gifts received by HUF from its members are exempted from Income Tax under Section 56(2)(vii)/ 56(2)(x) of the act.

However, provision of clubbing must be considered by member while giving gift to the HUF.

So, if any property is gifted by any member to HUF it will be tax free, but any income from such property will be deemed to be considered as income of the member as per clubbing provisions of Income tax. [Ref: Section 64(2) of the Act]

Gift by HUF to its Members

The issue of taxability of Gift by HUF to its members is controversial.

In the case of Gyanchand M. Bardia v. Income Tax Officer, Ward 1(2)(2), ITAT Ahmedabad bench has held that the same is taxable. The matter is pending at Gujarat high court.

In another case, Vineetkumar Raghavjibhai Bhalodia v. Income tax Officer, ITAT Rajkot Bench has held that the same is not liable to tax.

Hence before entering into this kind of transaction, position of law prevailing in respective state need to be considered.

Gifts to/by HUF to/by Non-Members of HUF

For individuals who are non-member of HUF, transfer of gifts will be considered same as it is case of gift received by a person from any non- relative.

Any gifts above Rs 50,000/-, immovable property gifts with stamp duty value above Rs 50,000/- and movable property without consideration having fair market value above Rs 50,000/- shall be held taxable in the hands of recipient.

Tax Advantage from HUF

The major advantage of creating a Hindu Undivided Family is that one can split the family income and thereby resulting in tax saving and reducing the tax outgo.

For better tax planning –

- Any gifts or inheritances meant for the benefit of all the members of a family make sure that such gift or inheritances are gifted specifically to the HUF, instead of separately to individual members of the

- The capital of a HUF can also be enhanced by borrowing funds from people who are not members. If the borrowings are specifically in the HUF’s name, and it is thereafter invested in the HUF’s name, the income arising on the investment will be regarded as the income of the

- Transfer individual funds to the HUF and then invest the money in tax- free instruments. Since the income from such investments will be tax- free, the clubbing provision will not be applied and it will not be clubbed with the individual’s income. The income arising on the reinvestment of the tax-free income will also not be clubbed, since only the income arising on transferred amounts is

An HUF can own self-occupied House property and avail benefit of deduction of loan interest and principal repayment.

HUF can take deduction under section 80C for the payment of life insurance premium as well as payment for ULIP for any of its members. HUF can also take deduction of deposit of amount in PPF account of any of its members.

HUF can take deduction under section 80D in relation to payment of health insurance policy of any of its members.

Other sections under which HUF can take benefit of deductions are section 80DD, 80DDB, 80G, 80GGA, 80GGC, 80TTA.

Partition of HUF

As per section 171 of the Income Tax Act, 1961 Partition means –

- where the property admits of a physical division, a physical division of the property, but a physical division of the income without a physical division of the property producing the income shall not be deemed to be a partition; or

- where the property does not admit of a physical division, then such division as the property admits of, but a mere severance of status shall not be deemed to be a partition.

Under the Dayabhaga School of Hindu law, the shares of members are already defined and therefore no physical division is required. On the other hand, under the Mitakshara School, mere intention to divide and specification of interest of various members may constitute a partition.

However as per the income tax act, only a physical division constitutes a partition. If it is not possible to have a physical division, then an adjustment will have to be made amongst coparceners to comply with the definition of partition under section 171 of the Income Tax Act.

There is two kind of partition – Partial Partition and Total Partition Under a Partial Partition, among the members of the family one or more coparceners may separate from others and the remaining coparceners may continue to be part of existing HUF. There can be a division/partition where only some of the property is divided while the balance of the property remaining joint.

Under a Total Partition, the entire HUF property is divided amongst all members and the family ceases to exist as an HUF.

It is important to note where a partial partition takes place in an HUF which was assessed as a HUF before; such Partial Partition is not recognized as partition under Income Tax Act. Such HUF will be continued to be assesses as no partition has been taken place.

For the purpose of legal proof of partition, it is necessary to record fact of partition on a document. It is necessary that stamp duty prescribed under the stamp duty legislation is also complied with.

It is noteworthy that the nature of the joint family property on partition shall continue to be property of the HUF as and when the recipient person is married. Hence the character of the property shall remain that of the HUF property. However, if person recipient of property is unmarried then, the property received on partition shall be assessed as individual property. On marriage, it will automatically be considered as property of his HUF.

It is important to note that any coparcener or member of a HUF does not have any definite share in the HUF property before partition and division. No coparcener or member be said to diminish directly or indirectly the value of his property or to increase the value of the property of any other coparcener by agreeing to take a share lesser than what he would have got if he would have gone to a court to enforce his claim. Resultantly, in a situation where property is not shared in equal proportion by the members of the HUF, the same cannot be treated as gift by one member to another member.

********

Disclaimer: Any contents of this HUF Series are solely for informational purpose. It does not constitute any kind of advice. Neither I accept any liabilities for any loss or damage of any kind arising out of any information through this knowledge series nor for any actions taken in reliance thereon. It is not substitute for detailed research or the exercise of professional judgment.

To Download Sample HUF Deed CLICK ME.

Article authored by:

HARIKRUSHNA JAJAL

As a Chartered Accountant (CA) Finalist and a commerce graduate, specialized in the field of taxation, with a keen interest in Income Tax, I am passionate about helping individuals and businesses to navigate the complex world of taxes. I have completed my graduation in commerce from Sardar Patel University with specialization in accounts and Business regulatory framework. Currently, I am working at Ahmedabad-based CA firm handling work related to Income Tax like income assessment, appeals and regular compliances related in income tax.

E-mail: harijajal32@gmail.com | LinkedIn: HariKrushna Jajal

You can book phone consultation/ assistance online with expert as mentioned below:

To book ITR filing with experts CLICK ME.

To book phone consultation with experts for any Income tax related matters CLICK ME.

To book consultation for Faceless Assessment with experts CLICK ME.

To book phone consultation with experts for GST related matters CLICK ME.

To book general phone consultation with expert CLICK ME.

![[Live] Updates and Tax changes for Budget 2023 | Tax on cryptocurrency | Income tax and GST udpates in Budget 2023 [Download Bill]](https://www.taxontips.com/wp-content/uploads/2023/02/Budget-2023-350x250.webp)

![[Live] Updates and Tax changes for Budget 2023 | Tax on cryptocurrency | Income tax and GST udpates in Budget 2023 [Download Bill]](https://www.taxontips.com/wp-content/uploads/2023/02/Budget-2023-120x86.webp)