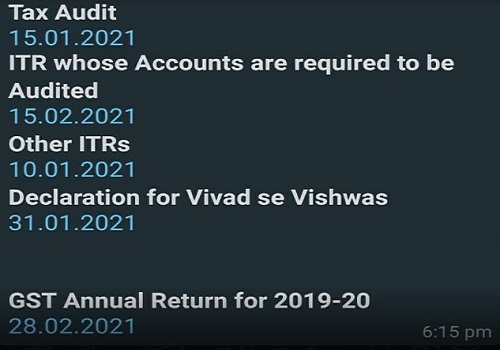

The due dates for Filing of Income tax return, Audit report and GST annual returns have been extended which is as under:

Due date for furnishing various audit reports under the Income tax act including: Tax Audit, report for financial transaction (Earlier extended due date 31.12.2020):

15.01.2021

Due date for filing of ITR whose Accounts are required to be Audited or partners of such partnership firm including companies (Earlier extended due date 31.01.2021):

15.02.2021

Due date for filing other ITRs i.e. ITRs which were earlier required to be filed on or before 31.07.2020 (Earlier extended due date 31.12.2020):

10.01.2021

Due date for filing Declaration under Vivad se Vishwas (Earlier extended due date 31.12.2020):

31.01.2021

Due date for passing order under Vivad se Vishwas (Earlier extended due date 30.01.2021):

31.01.2021

Due date for making payment of tax without interest (for taxpayers having tax below 1 lakh):

10.01.2021 and 15.02.2021 respectively as per due date of Income tax return.

Due date for furnishing GST Annual Return for 2019-20 (Earlier extended due date 31.12.2020):

28.02.2021 (Important thing to note that due date for filing GST annual return for FY 2018-19 is still 31.12.2020)

Government has finally extended the due date however we need to understand that when government is giving such a limited extension as compared to expected extension of upto 31.03.2021, we need to file our income tax return at the earliest.

Don’t wait for the last minute get your return filed at the earliest with our experts: CLICK HERE to book your ITR.

Click here to read the notification: https://twitter.com/IncomeTaxIndia/status/1344260412355665920?ref_src=twsrc%5Egoogle%7Ctwcamp%5Eserp%7Ctwgr%5Etweet

Comments 1