Any person who is liable to get his books of accounts audited under section 44AB needs to get a Form filed in Form 3CA-3CD or 3CB-3CD as applicable, from a Chartered Accountant.

Tax audit report needs to be filed by the Chartered Accountant and for filing the same the assessee has to assign him the said form on e-filing portal.

Income tax department had announced the said tax audit forms long ago and we had discussed about the same: CBDT enables Tax audit filing i.e. Form 3CD for AY 2021-22 on E-filing website | E-filing 2.0 – Taxontips. However, the assessee did not had the option to assign the form because of which the professional could not file the tax audit report and same was also discussed at: Filing of Form 3CA-CD or 3CB-CD enabled on e-filing website for AY 2021-22, but you cannot still file Tax audit report | Here’s why – Taxontips

Recently the Income tax e-filing portal has enabled the option to assign Tax audit Forms 3CA-3CD and 3CB-3CD by assessee to his/ her Chartered Accountant and the procedure is different from the procedure of assigning normal Forms to Chartered Accountant.

For assigning any Forms to a Chartered Accountant you need to first add him/ her as your CA on e-filing portal. To read the Procedure to “Add CA” Click HERE: How to add CA on new e-filing website for submitting various forms and reports | E-filing 2.0 – Taxontips.

Normally once you “Add CA” you get an option there itself to assign Forms, however in case of Tax audit forms you need to select different approach which is as under:

Once you Add CA, you need to go to E-file –> Income Tax forms –> File Income tax forms and then from there select Form 3CA-3CD or 3CB-3CD (available under “Person with business/ profession income) as applicable.

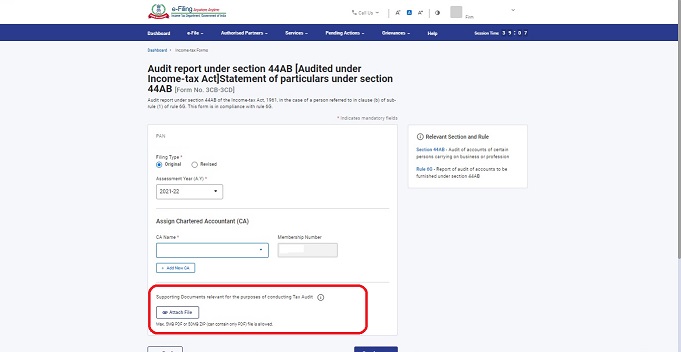

After you do that, you will see a window as under wherein you need to fill the details of the relevant Assessment year, details of your Chartered Accountant can be selected from the Drop down based on the CA you have added for your PAN and in the end you can even attach some documents which you wish him to consider for his Tax audit (although attaching document is not compulsory).

Once you assign this Form your Chartered Accountant will be able to submit Tax audit report, after which you can accept the same and in the end file your Income tax return.

Note: As of now many Chartered Accountants are not able to submit tax audit report even after assigning as the software providers are not able to generate the Tax audit report as they are saying that the Tax audit report Schema has not been made available to them.

The due date for filing of Tax audit report as of for FY 2020-21 is 15.01.2022.

You can book phone consultation/ assistance online with expert as mentioned below:

To book ITR filing with experts CLICK ME.

To book phone consultation with experts for any Income tax related matters CLICK ME.

To book consultation for Faceless Assessment with experts CLICK ME.

To book phone consultation with experts for GST related matters CLICK ME.

To book general phone consultation with expert CLICK ME.

![[Live] Updates and Tax changes for Budget 2023 | Tax on cryptocurrency | Income tax and GST udpates in Budget 2023 [Download Bill]](https://www.taxontips.com/wp-content/uploads/2023/02/Budget-2023-350x250.webp)

![[Live] Updates and Tax changes for Budget 2023 | Tax on cryptocurrency | Income tax and GST udpates in Budget 2023 [Download Bill]](https://www.taxontips.com/wp-content/uploads/2023/02/Budget-2023-120x86.webp)

Comments 1